CN 11-1911/B

Acta Psychologica Sinica ›› 2026, Vol. 58 ›› Issue (4): 651-666.doi: 10.3724/SP.J.1041.2026.0651

• Original article • Previous Articles Next Articles

MA Jia-Tao1,2, LI Shu1( ), HE Guibing1(

), HE Guibing1( )

)

Published:2026-04-25

Online:2026-01-16

Contact:

LI Shu, E-mail: Supported by:MA Jia-Tao, LI Shu, HE Guibing. (2026). The Framing Effect of Cross-Period Temporal Choice in the Loss Domain Will Influence the Preference for Debt-Swapping Decisions. Acta Psychologica Sinica, 58(4), 651-666.

Add to citation manager EndNote|Ris|BibTeX

URL: https://journal.psych.ac.cn/acps/EN/10.3724/SP.J.1041.2026.0651

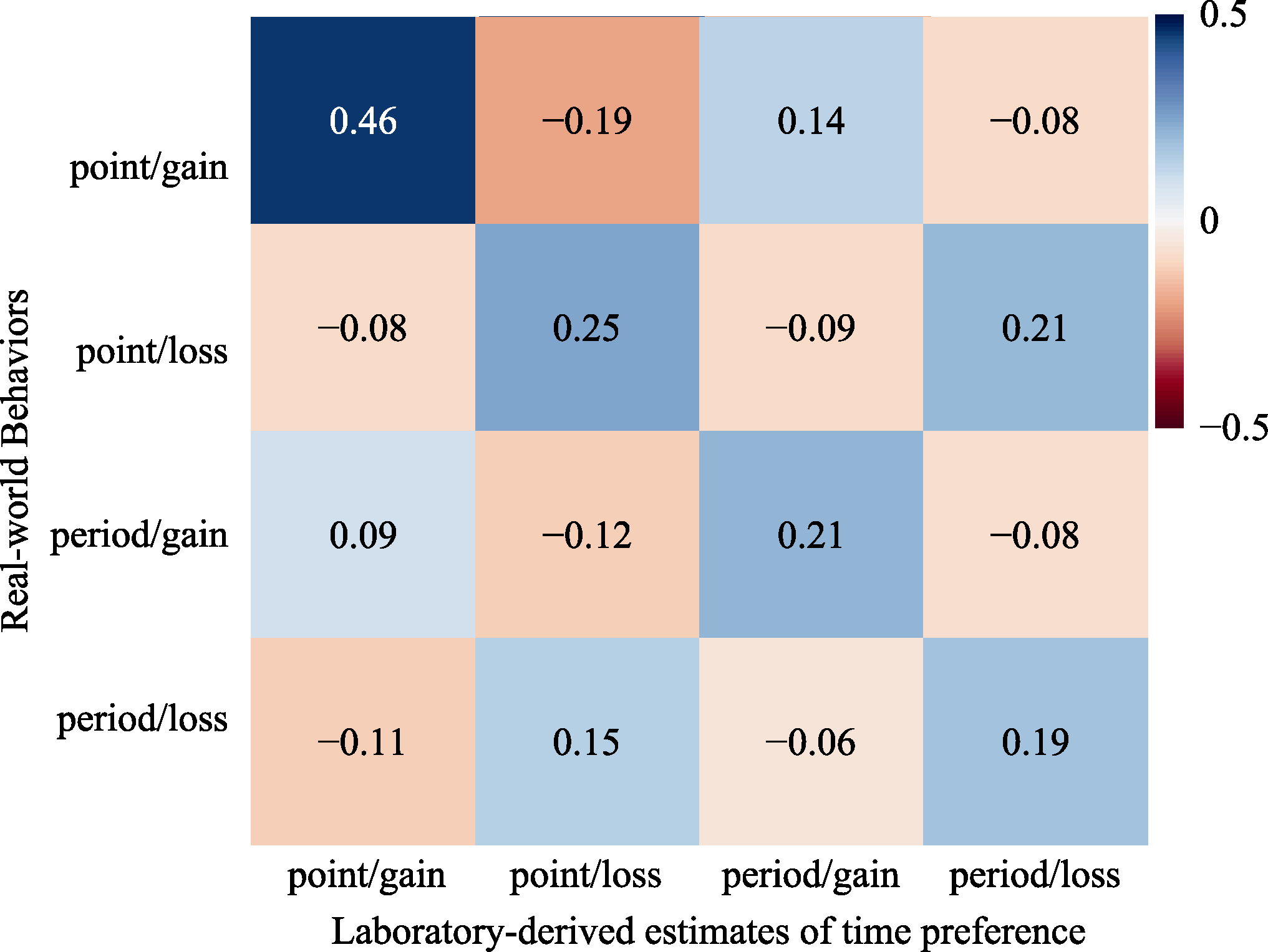

Figure 2. Heatmap of correlation coefficient matrix between “laboratory-derived estimates of time preference” and “real-world behaviors” (drawn using data from Ma et al. (2024)). Given the sufficient sample size (N = 1200), all coefficients reached statistical significance, and only coefficient values (i.e., effect sizes) are shown in the figure without separate significance notation. See electronic version for color figure.

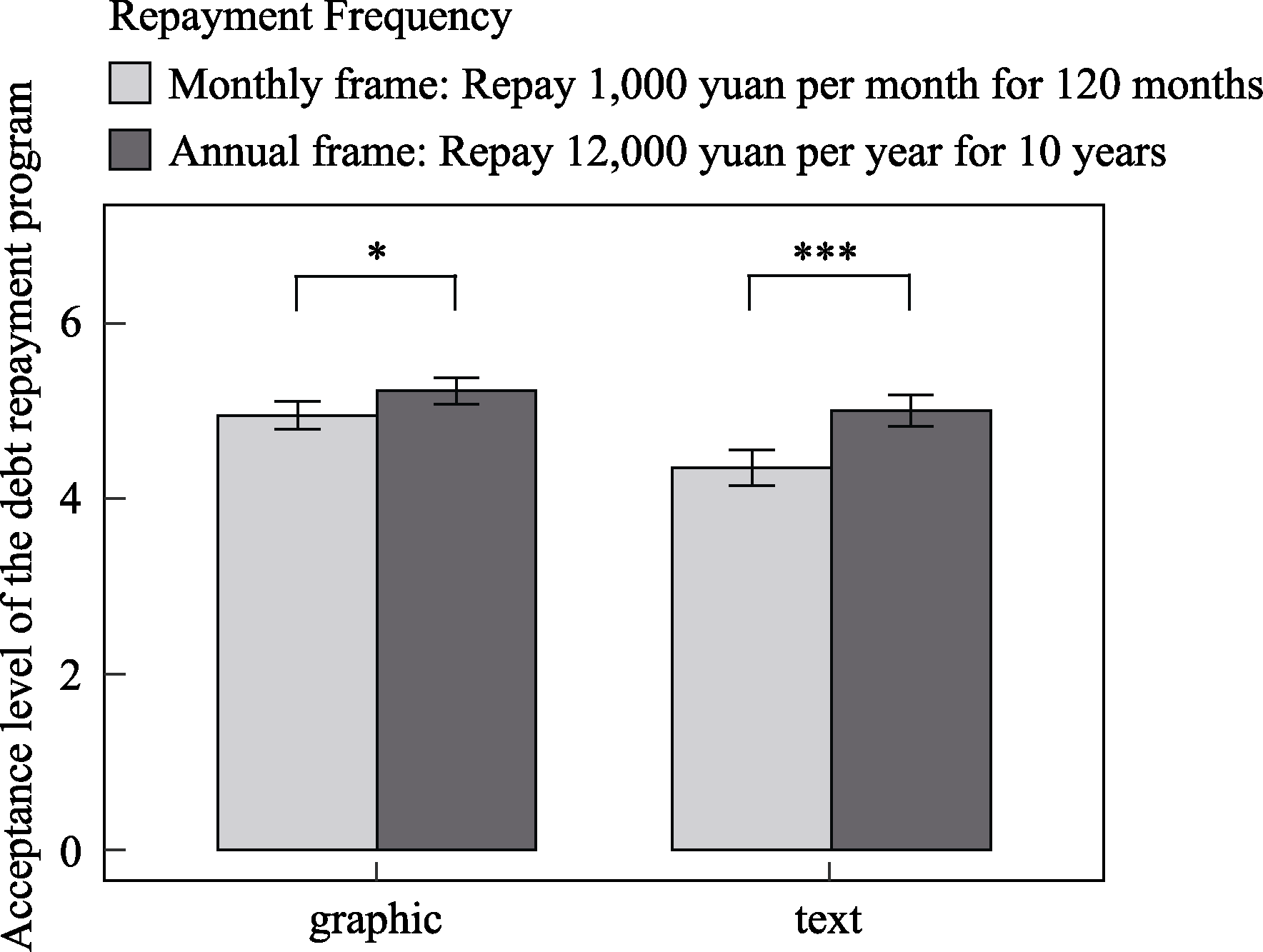

Figure 3. ALDRP under different presentation formats (text vs. graphic) and repayment frequencies (monthly vs. annual). The lower the repayment frequency (annual payment), the higher the decision-makers’ ALDRP. * p < 0.05; *** p < 0.001

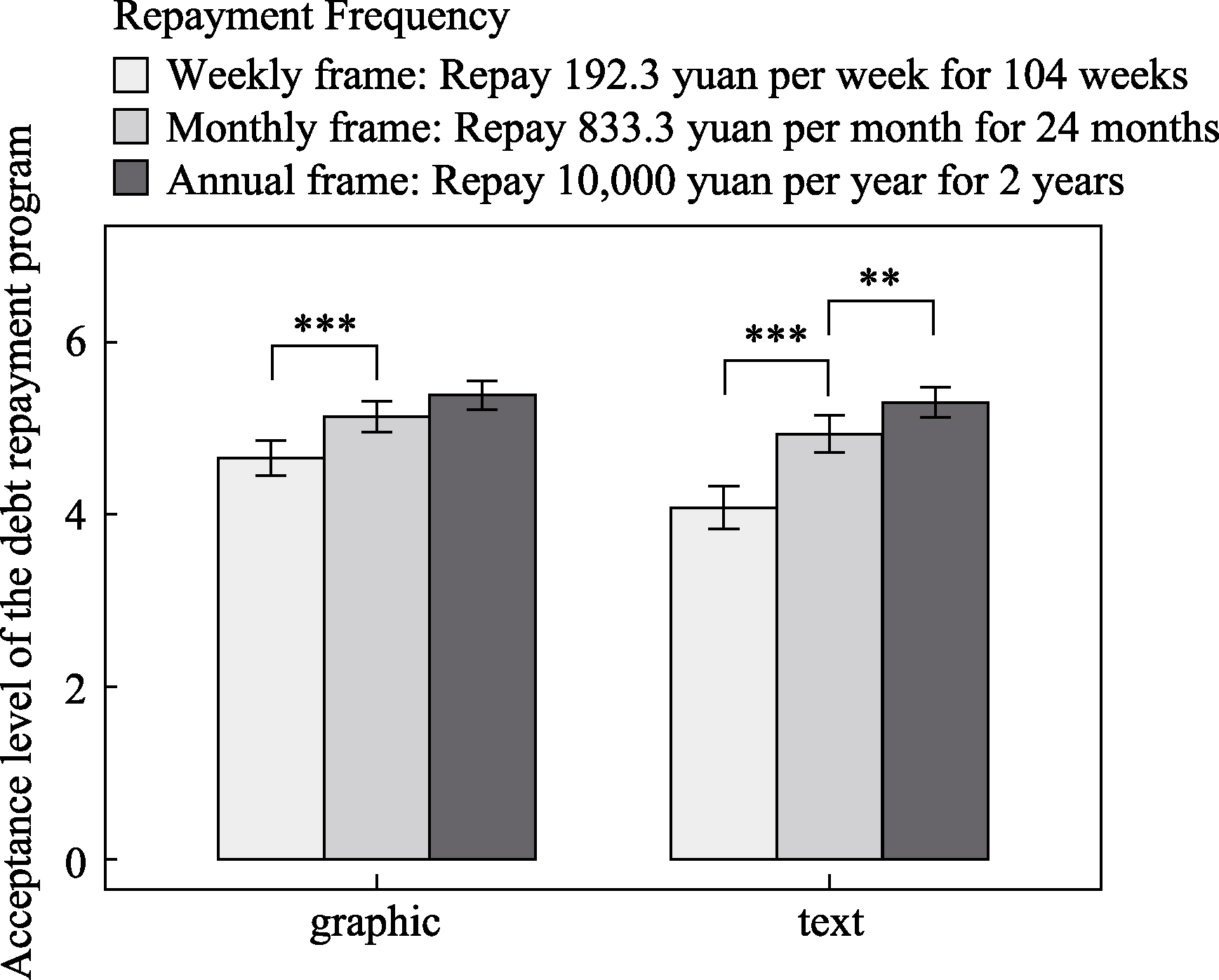

Figure 4. ALDRP under different presentation formats (graphic vs. text) and repayment frequencies (weekly vs. monthly vs. annual). As repayment frequency decreases (weekly→annual), decision-makers’ ALDRP increases. ** p < 0.01; *** p < 0.001

Figure 11. Left: US GDP changes expressed using “equidistant temporal frame”; Right: World GDP changes expressed using “non- equidistant temporal frame” (Source: https://howmuch.net/)

| [1] |

Arrow K. J. (1982). Risk perception in psychology and economics. Economic Inquiry, 20(1), 1-9.

doi: 10.1111/ecin.1982.20.issue-1 URL |

| [2] |

Bartels D. M., Li Y., & Bharti S. (2023). How well do laboratory-derived estimates of time preference predict real-world behaviors? Comparisons to four benchmarks. Journal of Experimental Psychology: General, 152(9), 2651-2665.

doi: 10.1037/xge0001380 URL |

| [3] |

Bonini B., Hadjichristidis C., & Graffeo M. (2018). Green nudging. Acta Psychologica Sinica, 50(8), 814-826.

doi: 10.3724/SP.J.1041.2018.00814 |

| [4] |

Faul F., Erdfelder E., Buchner A., & Lang A. G. (2009). Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41(4), 1149-1160.

doi: 10.3758/BRM.41.4.1149 pmid: 19897823 |

| [5] |

Frederick S., Loewenstein G., & O’donoghue T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351-401.

doi: 10.1257/jel.40.2.351 URL |

| [6] |

Geng X., Zhang K., Ma J., Yang H., Chen Z., & Li S. (2023). Blue, rather than red light can nudge employees to choose delayed but larger wage payment. Environment and Behavior, 54(9-10), 1227-1250.

doi: 10.1177/00139165231153160 URL |

| [7] |

Gigerenzer G., & Gaissmaier W. (2011). Heuristic decision making. Annual Review of Psychology, 62(1), 451-482.

doi: 10.1146/psych.2011.62.issue-1 URL |

| [8] |

Gigerenzer G., Luan S., & Liu Y. (2019). Are we truly irrational and almost impossible to educate? Analyzing the scientific evidence behind libertine paternalism. Acta Psychologica Sinica, 51(4), 395-406.

doi: 10.3724/SP.J.1041.2019.00395 |

| [9] |

Green L., Fristoe N., & Myerson J. (1994). Temporal discounting and preference reversals in choice between delayed outcomes. Psychonomic Bulletin & Review, 1(3), 383-389.

doi: 10.3758/BF03213979 URL |

| [10] |

Green L., & Myerson J. (2004). A discounting framework for choice with delayed and probabilistic rewards. Psychological Bulletin, 130(5), 769-792.

doi: 10.1037/0033-2909.130.5.769 pmid: 15367080 |

| [11] |

He G. -B., Li S., & Liang Z. -Y. (2018). Behavioral decision-making is nudging China toward the overall revitalization. Acta Psychologica Sinica, 50(8), 803-813.

doi: 10.3724/SP.J.1041.2018.00803 URL |

| [12] | Holm S. (1979). A simple sequentially rejective multiple test procedure. Scandinavian Journal of Statistics, 6, 65-70. |

| [13] |

Huang Y. -N., Jiang C. -M., Liu H. -Z., & Li S. (2023). Toward a coherent understanding of risky, intertemporal, and spatial choices: Evidence from eye-tracking and subjective evaluation. Acta Psychologica Sinica, 55(6), 994-1015.

doi: 10.3724/SP.J.1041.2023.00994 |

| [14] | Jiang C. -M. (2013). Mechanism of intertemporal choice: From a perspective of equate-to-differentiate model [Unpublished doctoral dissertation]. University of Chinese Academy of Sciences, Beijing, China. |

| [15] |

Jiang C. M., Chen L. N., Luo Q., Wang W., Zhou J., & Ma J. T. (2025). The token undermining effect: When and why adding a small reward to a dated outcome makes it less preferred. British Journal of Psychology, 116(2), 386-408.

doi: 10.1111/bjop.v116.2 URL |

| [16] |

Jiang C. -M., Liu H. -Z., Cai X. -H., & Li S. (2016). A process test of priority models of intertemporal choice. Acta Psychologica Sinica, 48(1), 59-72.

doi: 10.3724/SP.J.1041.2016.00059 |

| [17] |

Kahneman D., & Tversky A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-292.

doi: 10.2307/1914185 URL |

| [18] |

Kahneman D., & Tversky A. (1982). The Psychology of Preferences. Scientific American, 246(1), 160-173.

doi: 10.1038/scientificamerican0182-160 URL |

| [19] | Kang L., Kuang Y., Li S., Zheng X., & Du F. (2025). The time-space frame in road signs affects pathfinding driving performance: Results from Bayesian networks. Applied Cognitive Psychology, 39(4), e70094. |

| [20] |

Kim B. K., & Zauberman G. (2009). Perception of anticipatory time in temporal discounting. Journal of Neuroscience, Psychology, and Economics, 2(2), 91-101.

doi: 10.1037/a0017686 URL |

| [21] |

Kuang Y., Huang Y. N., & Li S. (2023). A framing effect of intertemporal and spatial choice. Quarterly Journal of Experimental Psychology, 76(6), 1298-1320.

doi: 10.1177/17470218221113519 URL |

| [22] |

Larrick R. P., & Soll J. B. (2008). The MPG Illusion. Science, 320(5883), 1593-1594.

doi: 10.1126/science.1154983 URL |

| [23] |

Levin I. P., & Gaeth G. J. (1988). How consumers are affected by the framing of attribute information before and after consuming the product. Journal of Consumer Research, 15(3), 374-378.

doi: 10.1086/jcr.1988.15.issue-3 URL |

| [24] |

Levin I. P., Gaeth G. J., Schreiber J., & Lauriola M. (2002). A new look at framing effects: Distribution of effect sizes, individual differences, and independence of types of effects. Organizational Behavior and Human Decision Processes, 88(1), 411-429.

doi: 10.1006/obhd.2001.2983 URL |

| [25] |

Levin I. P., Johnson R. D., & Davis M. L. (1987). How information frame influences risky decisions: Between-subjects and within- subject comparisons. Journal of Economic Psychology, 8(1), 43-54.

doi: 10.1016/0167-4870(87)90005-5 URL |

| [26] |

Levin I. P., Schneider S. L., & Gaeth G. J. (1998). All Frames Are Not Created Equal: A Typology and Critical Analysis of Framing Effects. Organizational Behavior and Human Decision Processes, 76(2), 149-188.

pmid: 9831520 |

| [27] | Li S. (1994). Equate-to-differentiate theory: A coherent bi-choice model across certainty, uncertainty and risk (Unpublished doctorial dissertation). University of New South Wales, Sydney, Australia. |

| [28] |

Li S. (1998). Can the conditions governing the framing effect be determined? Journal of Economic Psychology, 19(1), 133-153.

doi: 10.1016/S0167-4870(97)00039-1 URL |

| [29] | Li S. (2001). Allais paradox: A behavioral explanation. Acta Psychologica Sinica, 33(2), 176-181. |

| [30] | Li S. (2016). An equate-to-differentiate way of decision making(in Chinese). East China Normal University Press. (in Chinese). |

| [31] |

Li S., & Adams A. S. (1995). Is there something more important behind framing? Organizational Behavior and Human Decision Processes. 62(2), 216-219.

doi: 10.1006/obhd.1995.1044 URL |

| [32] | Li S., Fang Y. Q., & Zhang X. J. (2000). What makes frames work? Acta Psychologica Sinica, 32(2), 229-234. |

| [33] | Li S., & Xie X. (2006). A new look at the “Asian disease” problem: A choice between the best possible outcomes or between the worst possible outcomes? Thinking & Reasoning, 12(2), 129-143. |

| [34] | Li Y., Zhang X., & Chang X. (2015). China's National Balance Sheet 2015: Leverage Adjustment and Risk Management. China Social Sciences Press. |

| [35] |

Liu H. Z., Jiang C. M., Rao L. L., & Li S. (2015). Discounting or priority: Which rule dominates the intertemporal choice process? Acta Psychologica Sinica, 47(4), 522-532.

doi: 10.3724/SP.J.1041.2015.00522 |

| [36] |

Liu H. -Z., Li S., & Rao L. -L. (2018). Out of debt, out of burden: The physical burdens of debt. Journal of Experimental Social Psychology, 76, 155-160.

doi: 10.1016/j.jesp.2018.01.003 URL |

| [37] |

Loewenstein G., & Prelec D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economics, 107(2), 573-597.

doi: 10.2307/2118482 URL |

| [38] |

Luckman A., Donkin C., & Newell B. (2020). An evaluation and comparison of models of risky intertemporal choice. Psychological Review, 127(6), 1097-1138.

doi: 10.1037/rev0000223 URL |

| [39] | Luo X., Liang Q., & Yang X. (2017). “Gray Rhino” and “Black Swan” for Current China’s Economy. Bulletin of Chinese Academy of Sciences, 32(12), 1356-1370. |

| [40] | Ma J. T. (2025). Dual modes of temporal decision-making: Cross-period and cross-point decision-making [Unpublished Doctoral dissertation]. Zhejiang University, Hangzhou, China. |

| [41] | Ma J. T., He G. B., & Li S. (2023). A Study on cross-period temporal choice and Its Mechanisms: Different from cross-point temporal choice. The 4rd Annual Conference of Decision Making Psychology Professional Committee of Chinese Psychological Society. Xinjiang, China. |

| [42] | Ma J. T., He G. B., & Li S. (2024). Which decision - temporal decision via the trade-off between "earlier vs. later" or via the trade-off between "shorter vs. longer" - can explain and predict people's far-sighted behavior? The 5rd Annual Conference of Decision Making Psychology Professional Committee of Chinese Psychological Society. Tibet, China. |

| [43] | Ma J. T., Wang L., Chen L. N., He Q., Sun Q. Z., Sun H. Y., & Jiang C. M. (2021). Comparing mixed intertemporal tradeoffs with pure gains or pure losses. Judgment and Decision Making, 16(3), 709-728. |

| [44] |

Nan L. X., Park S., & Yang Y. (2023). Rejections are more contagious than choices: How another’s decisions shape our own. Journal of Consumer Research, 50(2), 363-381.

doi: 10.1093/jcr/ucad007 URL |

| [45] | Qiu Z., Wang Z., & Wang Z. (2022). Local government debt replacement plan and new implicit debt——Based on issuance scale and pricing of chengtou bonds. China Industrial Economics, 4, 42-60. |

| [46] |

Read D., Frederick S., Orsel B., & Rahman J. (2005). Four score and seven years from now: The date/delay effect in temporal discounting. Management Science, 51(9), 1326-1335.

doi: 10.1287/mnsc.1050.0412 URL |

| [47] |

Shen S. C., Khishignyam B., Ding Y., Ma J. T., Yang S. W., Kuang Y., … Li S. (2023). Changes in the intertemporal choices of people in or close to Chinese culture can predict their self-rated survival achievement in the fight against COVID-19: A cross-national study in 18 Asian, African, European, American, and Oceanian countries. Acta Psychologica Sinica, 55(3), 435-454.

doi: 10.3724/SP.J.1041.2023.00435 |

| [48] |

Shen S. C., Wang Y. M., Zhang H. B., & Ma J. T. (2023). Discount or trade off: The psychological mechanisms of intertemporal choice with double-dated mixed outcomes. Advances in Psychological Science, 31(7), 1121-1132.

doi: 10.3724/SP.J.1042.2023.01121 URL |

| [49] | Stanovich K. E., & West R. F. (1998). Individual differences in framing and conjunction effects. Thinking & Reasoning, 4(4), 289-317. |

| [50] |

Sun H. L., Li A. M., Shen S. C., Xiong G. X., Rao L. L., Zheng R., Sun H.Y., & Li S. (2020). Early departure, early revival: A "free from care" account of negative temporal discounting. Advances in Cognitive Psychology, 16(2), 103-116.

doi: 10.5709/acp-0289-0 URL |

| [51] | Sun H. -Y., Li A. -M., Chen S., Zhao D., Rao L. -L., Liang Z. -Y., & Li S. (2015). Pain now or later: An outgrowth account of pain-minimization. PLoS ONE. 10(3), e0119320. |

| [52] |

Sun H. -Y., Ma J. -T., Zhou L., Jiang C. -M., & Li S. (2022). Waiting is painful: The impact of anticipated dread on negative discounting in the loss domain. Judgment and Decision Making, 17(6), 1353-1378.

doi: 10.1017/S1930297500009451 URL |

| [53] |

Sun Y., Li S., Bonini N., & Su Y. (2012). Graph framing effects in decision making. Journal of Behavioral Decision Making. 25(5), 491-501.

doi: 10.1002/bdm.v25.5 URL |

| [54] | Sunstein C. R. (2014). Why nudge?: The politics of libertarian paternalism. Yale University Press. |

| [55] |

Tang S., Koval C. Z., Larrick R. P., & Harris L. (2020). The morality of organization versus organized members: Organizations are attributed more control and responsibility for negative outcomes than are equivalent members. Journal of Personality and Social Psychology, 119(4), 901-919.

doi: 10.1037/pspi0000229 pmid: 32105101 |

| [56] |

Thaler R. (2021). What’s next for nudging and choice architecture? Organizational Behavior and Human Decision Processes, 163, 4-5.

doi: 10.1016/j.obhdp.2020.04.003 URL |

| [57] | Thaler R. H., & Sunstein C. R. (2008). Nudge: Improving decisions about health, wealth, and happiness. New Haven, CT: Yale University Press. |

| [58] |

Tversky A., & Kahneman D. (1981). The framing of decisions and the psychology of choice. Science, 211(4481), 453-458.

doi: 10.1126/science.7455683 pmid: 7455683 |

| [59] |

Tversky A., & Kahneman D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297-323.

doi: 10.1007/BF00122574 URL |

| [60] |

Wang Z., Chen C., Mo J., Lu F., Ma J. T., Chen C., & He G. (2023). Experiencing Buddhist practices promotes nonbelievers’ preference for future rewards in intertemporal choices. European Journal of Social Psychology, 53(1), 230-244.

doi: 10.1002/ejsp.v53.1 URL |

| [61] | Xu L. J., Liang Z. Y., Wang K., Li S., & Jiang T. Z. (2009). From discounting future gains to future losses. China Basic Science, 11(6), 25-27. |

| [62] |

Zauberman G., Kim B. K., Malkoc S. A., & Bettman J. R. (2009). Discounting time and time discounting: Subjective time perception and intertemporal preferences. Journal of Marketing Research, 46(4), 543-556.

doi: 10.1509/jmkr.46.4.543 URL |

| [63] | Zhang K. (2016). Column call for papers: Behavioral decision-making is nudging China toward the overall revitalization. Acta Psychologica Sinica. https://journal.psych.ac.cn/xlxb/CN/news/news13.shtml |

| [64] | Zhang S., & Li S. (2018). Exploring behavioral public administration: Content, method and trend. Journal of Public Administration, 11(1), 1-36+219. |

| [65] | Zhang Y. -Y., Zhou L., Li S., & Liang Z. -Y. (2022). Computation of subjective value does not always elicit alternative-based information searching in intertemporal choice. Journal of Behavioral Decision Making, 35(4), 1-13. |

| [66] | Zhang Y. Y., Zhou L., You X. Q., Li S., & Liang Z. Y. (2018). Is intertemporal decision-making based on a temporal discounting process? Evidence from doubledissociation paradigm. Scientia Sinica (Vitae), 48(5), 592-608. |

| [67] |

Zhou L., Li A. M., Zhang L., Li S., & Liang Z. Y. (2019). Similarity in processes of risky choice and intertemporal choice: The case of certainty effect and immediacy effect. Acta Psychologica Sinica, 51(3), 337-352.

doi: 10.3724/SP.J.1041.2019.00337 |

| [68] |

Zhou L., Yang Y., & Li S. (2022). Music-induced emotions influence intertemporal decision making. Cognition and Emotion, 36(2), 211-229.

doi: 10.1080/02699931.2021.1995331 URL |

| [1] | XU Lan, CHEN Quan, CUI Nan, GU Hong. “Win-win” vs. “sacrifice”: Impact of framing of ethical consumption on trust in algorithmic recommendation [J]. Acta Psychologica Sinica, 2024, 56(2): 179-193. |

| [2] | SUN Qingzhou, HUANG Jingru, YU Xiaofen, GAO Qingde. Give a man a fish or teach him to fish? Differences in donor behavior between high and low social classes [J]. Acta Psychologica Sinica, 2023, 55(10): 1677-1695. |

| [3] | CUI Fang, YANG Jiamiao, GU Ruolei, LIU Jie. Functional connectivities of the right temporoparietal junction and moral network predict social framing effect: Evidence from resting-state fMRI [J]. Acta Psychologica Sinica, 2021, 53(1): 55-66. |

| [4] | Gerd GIGERENZER, LUAN Shenghua, LIU Yongfang. Are we truly irrational and almost impossible to educate? Analyzing the scientific evidence behind libertine paternalism [J]. Acta Psychologica Sinica, 2019, 51(4): 395-406. |

| [5] | HE Gui-Bing, LI Shu, LIANG Zhu-Yuan. Behavioral decision-making is nudging China toward the overall revitalization [J]. Acta Psychologica Sinica, 2018, 50(8): 803-813. |

| [6] | LU Xi, HSEE, Christopher K. Joint evaluation versus single evaluation: A field full of potentials [J]. Acta Psychologica Sinica, 2018, 50(8): 827-839. |

| [7] | WANG Xiaozhuang, AN Xiaojing, LUO Haoshuang, XU Sheng, YU Xin, HU Shiya, WANG Yuhan. Anchoring effect as a nudge on improving public health: Two field experiments [J]. Acta Psychologica Sinica, 2018, 50(8): 848-857. |

| [8] | LI Aimei, WANG Haixia, SUN Hailong, XIONG Guanxing, YANG Shaoli . The nudge effect of “foresight for the future of our children”: Pregnancy and environmental intertemporal choice [J]. Acta Psychologica Sinica, 2018, 50(8): 858-867. |

| [9] | MA Wen-Juan,SUO Tao,LI Ya-Dan,LUO Li-Zhu,FENG Ting-Yong,LI Hong. Dissecting the Win-Loss Framing Effect of Intertemporal Choice: Researches from Intertemporal Choice of Money-Gain & Loss [J]. Acta Psychologica Sinica, 2012, 44(8): 1038-1046. |

| [10] | SONG Guang-Wen,XIA Xing-Xing,LI Cheng-Zong,HE Yun-Feng. Influences of Temporal Distances, Cover Story, and Probability on Framing Effect [J]. , 2012, 44(7): 957-963. |

| [11] | WU Yan,ZHOU Xiao-Lin. The Context-Dependency of Fairness Processing: Evidence from ERP Study [J]. , 2012, 44(6): 797-806. |

| [12] | HE Wei,LONG Li-Rong. The Effects of Pay System Frame and Performance Appraisal on Individual’s Acceptance of Pay for Performance Plan [J]. , 2011, 43(10): 1198-1210. |

| [13] | SUN Yan,XU Jie-Hong,CHEN Xiang-Yang. The Effects of Cover Stories, Framing, and Probability on Risk Preference in Investment Decision-Making [J]. , 2009, 41(03): 189-195. |

| [14] | ZHANG Wen-Hui,WANG Xiao-Tian. Self-framing, Risk Perception and Risky Choice [J]. , 2008, 40(06): 633-641. |

| [15] | Li Shu, Fang Yongqing (School of Psychology, University of New South Wales, Sydney, 2052, Australia Nanyang Business School, Nanyang Technological University, Singapore 639798) Maria Zhang (Department of Nutrition and Food Sciences, Hua Nan Women's Colleg. WHAT MAKES FRAMES WORK? [J]. , 2000, 32(02): 229-234. |

| Viewed | ||||||

|

Full text |

|

|||||

|

Abstract |

|

|||||