1 引言

“家有敝帚, 享之千金。” —— 汉·刘珍《东观汉纪·光武帝纪》

一把世人眼中破旧的扫帚在其主人的眼里却十分珍贵, 或许早在千年前古人就对这异于常理的现象充满了疑惑。“价值千金”虽是对“人们爱惜自己财产”的一种夸张性表达, 但类似的情境在现实生活中却极为常见。一旦拥有了某种物品, 人们对该物品所赋予的价值要高于没有拥有时的估价, 该现象即为禀赋效应(Thaler, 1980)。

禀赋效应描述的是一个经济学现象, 但其背后的解释机制绕不开心理学。因此, 可以说它是经济学和心理学两个学科碰撞的结果。传统经济学认为, 如果忽略收入影响和交易成本, 愿意为一样物品支付的价格应等于愿意出售的价格(罗伯特, 丹尼尔, 2009/2009)。塞勒却发现, 传统经济学无法解读生活中的一些“反常”现象——人们对自己所拥有的物品会赋予更高的价值。塞勒认为预期理论中的损失厌恶能够解释这些现象, 并由此提出禀赋效应(Thaler, 1980)。此后的经济学家们主要在该效应的稳定性、普遍性等方面进行了探索, 发展出相应的经济学理论模型(Kőszegi & Rabin, 2006)。而心理学家介入后, 则从偏差的认知过程、心理所有权和进化优势等各方面深入解释其内在机制(Beggan, 1992; Carmon & Ariely, 2000; Huck, Kirchsteiger, & Oechssler, 2005; Johnson, Häubl, & Keinan, 2007; Morewedge & Giblin, 2015; Weaver & Frederick, 2012), 将人的认知、情感等传统经济学看来无关的因素加入到冷酷无情的经济学理论当中, 并借鉴心理学的研究范式, 使用实证研究手段进行验证, 提高了经济学理论本身的解释力和预测力。禀赋效应的发现具有独创性与开拓性, 30多年来也吸引了无数研究者不断探索与求证。它正是经济学和心理学两个学科的碰撞而产生的精彩结果: 基于违背传统经济学理论的“反常”现象提出禀赋效应, 继而对“反常”现象进行心理学层面的解读, 并反复验证为符合“常理”的决策行为。

2 “反常”的解读: 葡萄酒之谜

也许“诡诞不经”的现象需要同样“诡诞不经”的人来发现。塞勒发现禀赋效应并非偶然, 而是源于他对经济学理论的批判性态度和对生活中反常现象的观察和思考。早在罗切斯特大学经济学系读书的时候, 他就是一个尖锐的“异端”, 除了对课上的经济学理论进行质疑外, 他对传统经济学收集和分析市场数据的研究方法也不太感兴趣。不过塞勒十分热衷于观察和记录他周围朋友和老师的非理性行为, 他甚至基于这些观察列了一份“非理性行为清单” (Thaler, 2015)。这份清单为塞勒后续的许多研究工作奠定了基础, 其中也包括禀赋效应。

塞勒一直对葡萄酒有强烈的偏好, 因此他对有相同爱好的理查德·罗塞特教授的非理性行为尤其感兴趣。罗塞特教授喜好收藏葡萄酒, 但他既不会用低于100美元的价格出售他收藏的葡萄酒, 也不会收藏价格高于35美元的葡萄酒。卖价和买价之间的巨大差异似乎无法用传统的经济学理论进行解释。罗塞特教授自己并不认为这一行为有何怪异之处, 但塞勒却耿耿于怀。这种不一致的决策背后似乎隐含着某种规律, 会稳定地对个体的价值评估产生影响, 但他一直无法解释这个问题。

1976年的一次会议上, 在卡尼曼的学生费斯科霍夫(B. Fischhoff)的推荐下, 塞勒研读了预期理论(prospect theory)的手稿。他意识到预期理论中的损失厌恶能够对该效应做出解释, 其解决方法就是摒弃标准理论, 承认人的偏好是有差异的。1980年, 塞勒提出了禀赋效应, 虽然在这之后塞勒并未对该效应开展更多的研究, 但他迈出的这一步却是开拓性的。更重要的是, 塞勒在经济学和心理学之间搭建一座桥梁, 将心理学理论和研究方法引入经济学领域, 科学地解释了禀赋效应这一非理性行为背后合理的心理基础和规律, 并引领了一番禀赋效应的研究热潮, 使得大量经济学家和心理学家都投身于对该效应的探寻中。

3 “常理”的验证: 理论的争论与发展

一石激起千层浪。30多年以来, 大量研究者致力于探究禀赋效应的内在机制, 试图为生活中的“反常”现象找出合乎常理的解答。

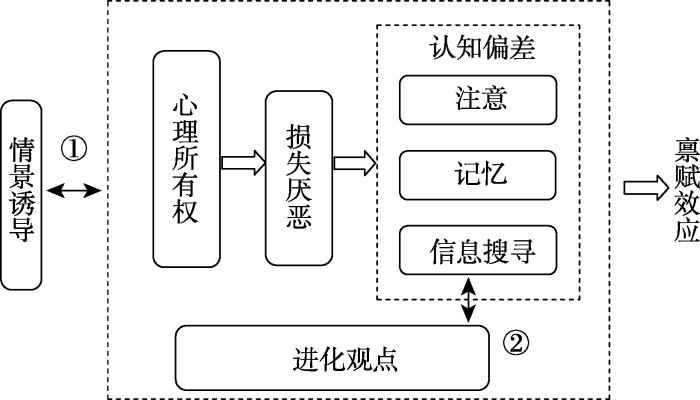

禀赋效应的发现与探究基于两种范式, 在物物交换范式中(exchange paradigm; Hood, Weltzien, Marsh, & Kanngiesser, 2016; Kahneman, Knetsch, & Thaler, 1990), 被试被随机分配一种物品(钱或杯子), 在随后的交换过程中却表现出不愿交换成另一种物品的现象, 该交换率低于随机率(50%); 而在估价范式中(valuation paradigm; Fehr, Hakimov, & Kübler, 2015; Kahneman et al., 1990), 被试被随机赋予买者或卖者身份, 分别给予金钱或物品, 结果发现卖者愿意出售该物品的最低价格(WTA)显著高于买者愿意为该物品支出的最高价格(WTP), WTA约为WTP的2至3倍(Kahneman et al., 1990)。这两种是禀赋效应的经典研究范式, 一直沿用至今, 帮助研究者们探寻禀赋效应的奥秘。通过这两种范式, 对禀赋效应的解释已不仅仅限于预期理论中的损失厌恶(Kahneman & Tversky, 1979; Thaler, 1980), 众多研究者从心理所有权、认知偏差、进化等不同角度对该现象进行反复论证和解释(见图1)。

图1

3.1 损失厌恶(loss aversion)

损失厌恶是Thaler (1980)对禀赋效应内在机制采用的解释。根据预期理论(Kahneman & Tversky, 1979), 人们的效用曲线是“S”型的, 决策者进行决策时, 根据参照点形成收益或损失的判断。损失区的价值函数是凸函数, 而收益区的价值函数则为凹函数, 且损失函数的斜率远大于收益函数的斜率, 即损失造成的伤害程度远大于等量收益带来的快乐程度, 该现象就是“损失厌恶”。如果将现状(status quo)作为参照点, 对于卖者来说, 卖出商品是一种损失, 而买方得到商品则是获益。由于人的损失厌恶这一特性, 在卖出商品时相比于买入时会感知到更高的价值, 从而产生WTA和WTP不对称的禀赋效应(Thaler, 1980)。

基于预期理论, 如何定义“损失”依赖于参照点, 而参照点可以是个体当前的状态, 也可以是渴望、预期、社会规范或是社会比较等(Ericson & Fuster, 2014)。Kőszegi和Rabin (2006)提出的基于预期的参照点理论(expectation-based reference points theory)发展了预期理论, 将对未来结果的当前预期而非现状作为参照点。例如, 获得400元意外之财对个体而言是收益, 而对于预期获得600元的个体而言获得500元就是损失。该理论认为禀赋效应源于双方没有交易的需求和倾向, 当人们交易的意愿增加, 直到确知交易一定能完成时, 禀赋效应就会消失(Ericson & Fuster, 2011)。这一理论也为先前研究中禀赋效应的消失提供了解释。如Engelmann和Hollard (2010)发现通过让被试重复进行交易会消除禀赋效应, 因为这一流程提高了被试对交易发生的预期。

近年来神经生理方面的研究也进一步证明了禀赋效应过程中的损失厌恶。Weber等人(2007)首次采用功能性核磁功能成像(fMRI)的方法, 发现被试在售卖时杏仁核活动比购买时更强, 这和损失厌恶所引起的过度恐惧反应一致(Camerer, 2005)。此外, Knutson等人(2008)的研究进一步发现, 内侧前额叶皮层(MPFC: medial prefrontal- cortex)的激活与购买和选择情境中的价格显著负相关, 与售卖情境中的价格正相关, 这与过往研究中发现的MPFC与收益正相关、与损失负相关结果相一致(Knutson, Fong, Bennett, Adams, & Hommer, 2003)。同时研究者还发现被试在售卖时右侧脑岛的激活水平能显著预测禀赋效应(de Martino, Kumaran, Holt, & Dolan, 2009; Knutson et al., 2008), 而脑岛的激活被认为与痛苦相关联(Sanfey, Rilling, Aronson, Nystrom, & Cohen, 2003)。当被试在服用了乙酰氨基酚这种可以减少损失带来的痛苦的药物之后, 卖出手中的商品对于卖者来说也确实变得更加容易了(Dewall, Chester, & White, 2015)。

一直以来, 损失厌恶是禀赋效应最通常的解释机制, 有研究者对比了几种理论, 也发现损失厌恶能够最好地解释禀赋效应(Pachur & Scheibehenne, 2017)。但这种理论也受到了一些研究者的质疑, 他们认为损失规避并不能解释所有的问题, 比如人们对“放弃拥有”的厌恶可能是禀赋效应的重要原因, 而非单纯对损失的厌恶(Schurr & Ritov, 2013)。同时有研究者提出心理所有权理论也可以解释禀赋效应(Beggan, 1992; Dommer & Swaminathan, 2013; Morewedge, Shu, Gilbert, & Wilson, 2009)。

3.2 心理所有权(the ownership effect)

早在50多年前, Heider (1958)就提出心理所有权能提升对所拥有物品的喜好。所有权理论认为, 个体会在自己与拥有物间建立联系(Beggan, 1992), 拥有物是自我的延伸, 内隐的自我评价会转移至与之相联系的拥有物上。通常人们对自我(特征、能力等)的判断有自我提升偏差(Heck & Krueger, 2016), 因此与自我相联系的拥有物也可能被评价得更为积极(Hood et al., 2016), 导致个体对拥有物赋予更高的价值, 从而产生禀赋效应(Beggan, 1992; Chatterjee, Irmak, & Rose, 2013; Dommer & Swaminathan, 2013; Shu & Peck, 2011)。因此影响自我评价的体验(例如: 自我威胁事件或骄傲事件)也会影响禀赋效应(Alexopoulos, Šimleša, & Francis, 2015)。同时, 国内研究者通过电生理研究发现, 不仅仅是自我提升, 他人贬损也能解释所有权的提升, 从而导致禀赋效应(Huang & Wu, 2016)。之后的研究进一步发展了所有权理论, 例如, 有研究认为禀赋效应并非因为客观地拥有某件物体, 而是源于拥有物体的主观所有权感受(Reb & Connolly, 2007), 因此即便是过去的所有权经历(Strahilevitz & Loewenstein, 1998), 如触摸等能产生所有权感受的行为(Brasel & Gips, 2014; Florack, Kleber, Busch, & Stöhr, 2014)也会影响物品评价, 同时研究发现拥有物品的时间越长, 对物品的评价也会越高(Strahilevitz & Loewenstein, 1998)。

有趣的是, Knutson等人(2008)的研究证实了内侧前额叶皮层(MPFC)基于损失厌恶对禀赋效应的解释, 但同样也支持了心理所有权对禀赋效应的解释。大量研究表明, MPFC与自我意识紧密相关, 例如相较于评价他人的特质, 个体评价自我的特质时MPFC有更强的激活(Araujo, Kaplan, & Damasio, 2013)。同时在中国文化背景下, 研究者发现禀赋效应不仅出现在自己的物品上, 也出现在亲密他人(包含在“自我”中的母亲、恋人、好朋友等)的物品上, 腹内侧前额叶(VMPFC)都存在显著的激活, 这也进一步为所有权理论提供了支持(Feng, Zhao, & Donnay, 2013; Zhao, Feng, & Kazinka, 2014; 郭文敏, 杨思佳, 罗俊, 叶航, 2017)。

基于所有权理论, 一些研究者试图挑战损失厌恶对禀赋效应的解释(Dommer & Swaminathan, 2013; Morewedge et al., 2009)。Morewedge等人(2009)通过实验设计分离了损失厌恶和所有权, 认为纯粹所有权理论(mere ownership effect)就可解释禀赋效应。损失厌恶需建立在获益与损失的心理不对称上, 而所有权只要拥有某个物体即可发生(Beggan, 1992; Morewedge & Giblin, 2015)。研究者发现购买的商品不是为自己所用(二次销售或换取其他物品时)时, 禀赋效应并不会出现, 也为这类观点提供了支持(Kahneman et al., 1990; Svirsky, 2014)。而另一些研究者则提出, 对禀赋效应的解释应同时结合损失厌恶和所有权两种理论(Chatterjee et al., 2013; Ericson & Fuster, 2014; Shu & Peck, 2011)。例如, Chatterjee等人(2013)提出, 所有权理论认为拥有物包含着重要的自我定义, 售出与自我相联系的物品是一种心理上的相对损失, 会对个体构成自我威胁, 因此个体采用自我提升行为即提高对拥有物的评价来维护自我概念, 继而产生禀赋效应(Chatterjee et al., 2013; Dommer & Swaminathan, 2013)。因此, 心理所有权可以看作损失厌恶发生的基础, 而损失厌恶的核心在于参照依赖(reference dependence), 将拥有物体的初始状态的感知作为参照点, 购买即为相对收益, 售卖即为相对损失(Shu & Peck, 2011)。

3.3 偏差的认知过程(Biased cognitive processing)

损失厌恶一直是禀赋效应最广泛采用的解释机制(Kahneman & Tversky, 1979; Thaler, 1980), 然而损失厌恶只关注基于参照依赖的外在状态, 极少谈及个体内在的认知过程(Willemsen, Böckenholt, & Johnson, 2011), 而了解个体的认知过程是预测和促进行为的关键(Pachur & Scheibehenne, 2012)。例如, 黄劲松和孙建伟(2009)在产品更换决策中验证了买卖双方的认知偏差, 即买方会高估旧产品的属性, 而卖方会高估新产品的属性。因此, 一些认知理论提出购买或售卖可以产生不同的认知框架, 个体在不同的框架下会产生注意、记忆提取、信息搜寻等偏差, 进而影响物品的评价(Ashby, Dickert, & Glockner, 2012; Carmon & Ariely, 2000; Johnson et al., 2007; Morewedge & Giblin, 2015; Weaver & Frederick, 2012)。

3.3.1 注意分配

大量研究发现, 注意能反映和影响决策偏好(Suri & Gross, 2015)。Carmon和Ariely (2000)提出禀赋效应源于交易中的聚焦放弃效应(Focus on the Forgone), 即个体对将要失去的物体更为关注。交易中, 购买者关注他们潜在的支出, 而售卖者则关注他们即将放弃的物品, 这种关注偏差会导致禀赋效应。研究者同时强调, 这种偏差不仅仅是诸如售卖者对交易物品感受到更高的价值, 而是双方在交换中强调不同的方面。买者放弃金钱, 因此对金钱的评价更可能受价格比较标准等因素影响, 例如参照价格等(Kalyanaram & Winer, 1995); 而卖者放弃物品, 更可能受到物品相关的因素影响, 例如放弃物品的态度等。买卖双方注意关注点的不同通过眼动等实验手段也得到了进一步验证(Ashby et al., 2012)。

3.3.2 记忆提取

此外, 质询理论(Query Theory)从记忆的角度对禀赋效应进行解释, 个体在决策过程中会从记忆中提取信息并整合(Johnson et al., 2007)。它包含三个假设: 第一, 偏好相关信息(preference- relevant information)按照一定顺序通过评价性问题或质询(queries)获得; 第二, 最先获取的信息最为丰富, 在决策过程中所占权重最大; 第三, 由于记忆的输出干扰(output interference)和提取抑制(retrieval inhibition), 较早质询的信息会干扰随后与之相关的信息, 因此越早的信息对决策的预测作用越强(Spälti, Brandt, & Zeelenberg, 2017)。Johnson等人(2007)采用估价范式, 通过层面列表法(aspect listing)让被试记录在对物品(杯子)估价过程中考虑到的因素, 研究发现买卖双方在对物品估价时会产生不同的质询内容和质询次序, 卖者最先质询提升所售物品价值的相关信息(关于物品的积极想法和关于金钱的消极想法), 而买者则与之相反, 而改变质询的顺序和内容能影响禀赋效应。

3.3.3 参照价格理论

质询理论对禀赋效应的解释(Johnson et al., 2007)依赖于个体内部信息的搜索, 而参照价格理论主要关注外部信息的搜索, 搜索的不同结果可能导致个体对物体价值不同的感知, 进而导致禀赋效应。该理论认为, 一件商品的保留价格是其自身价值和市场售价的双重反映。但是卖家给予市场价格更高权重, 而买家则更关注商品的价值(Simonson & Drolet, 2004), 因此双方对同一件商品的估价出现差异。根据Weaver和Frederick (2012)的研究, 人们对商品的出价依赖于感受到的商品价值与搜寻到外在参照价格的差异。大部分市场条件下, 市场参照价格均高于商品价值, 因此卖家普遍出价较高, 而买家愿意接受的价格较低。而在代币等市场上, 参照价格和商品价值相等, 买卖双方出价也相同, 因此禀赋效应消失(Kahneman et al., 1990)。该结论也得到了相关眼动实验的验证(Ashby et al., 2012)。双方内心参照价格不同使得他们对商品的评价出现差异, 外在表现就是禀赋效应。

总之, 参照价格理论认为禀赋效应的根源是卖家对交易负效用的厌恶, 即他们不愿意在交易中吃亏(Brown, 2005), 这与损失厌恶理论(Chatterjee et al., 2013; Thaler, 1980)所提出的观点不同。正如很多学者指出的那样(Weaver & Frederick, 2012), 消费者的购买决策受交易价值, 即实际售价与预期售价之差距影响, 而预期售价则由先前经验和当前购物环境等多种因素决定(Briesch, Krishnamurthi, Mazumdar, & Raj, 1997; Kalyanaram & Winer, 1995)。正是对环境信息搜索的不同结果, 导致了买卖双方对同样商品的价值感知出现了差异。

3.4 进化的观点

进化观点认为, 双边交易一直是人类社会重要特征, 在进化过程中获得有利结果的群体有更大的存活概率, 而禀赋效应就有利于推动良好结果的出现(Huck et al., 2005)。正因如此, 长期来看拥有积极禀赋效应的群体不会灭绝, 而他们从之前的成功经验中学习到的东西通过代际传承, 变成后代偏好选择时的一种本能。人类和许多生物在行为上的相似可被认为是进化的证据。例如, 研究者发现黑猩猩对已经拥有的东西比未来可能获得的东西偏好更强(Brosnan et al., 2007), 即它们也有禀赋效应, 且这一效应在对进化意义更大的物品类别(如食物)上更加明显(Drayton, Brosnan, Carrigan, & Stoinski, 2013)。与人类认知系统类似的卷尾猴同样展现出类似倾向。Chen, Lakshmina- rayanan和Santos (2006)发现, 卷尾猴在模拟的人类市场交易中表现出对价格变化、预期收益的敏感。同时, 尽管程度较低, 但也有损失厌恶和参照依赖的倾向。进一步研究显示, 禀赋效应在它们身上也表现得非常明显(Lakshminaryanan, Chen, & Santos, 2008)。

人类共有的一些决策偏见可能植根于漫长进化过程中的自然选择。Harbaugh, Krause和Vesterlund (2001)在5岁儿童身上发现了禀赋效应, 且这一效应在成年人身上并未显著降低, 说明禀赋效应是较为稳定的参照依赖偏好, 并非由对市场交易规则等经验缺乏所致。这也为进化的观点提供了依据。研究者们还发现了该效应的情景特异性: 黑猩猩对工具的禀赋效应只有在该工具即时可用的前提下才会出现(Brosnan et al., 2007)。这表明人类不同的表现很可能是漫长进化过程中最大化自身利益而发展出来的行为模式。

然而这一观点也受到了挑战。Apicella, Azevedo, Christakis和Fowler (2014)在非洲某个原始部落进行的实验中发现, 与外界几乎没有任何接触的部落人群未展现出禀赋效应, 而与周围村庄往来的增加则使得禀赋效应提高。因此, 禀赋效应可能并非为祖先一直拥有并传承下来的特性, 而是人们在长期市场交易中习得的行为。这一结果也支持了参照价格理论。原始部落与其他近人类动物研究结果的差异可能有两种原因。其一是实验室中的近人类动物其实早已暴露在经济环境中, 部分动物在实验前还经历过代币训练, 因此禀赋效应可能并非先天就有的倾向。其二是, 尽管禀赋效应确实是在进化过程中形成并不断巩固的, 但采集-狩猎的文化特征抑制了这种倾向。同时, 不少研究(List, 2003; Plott & Zeiler, 2005; Shogren, Shin, Hayes, & Kliebenstein, 1994)也发现, 交易练习和重复试验可以使被试积累市场经验, 此时购买出价(WTP)和售出要价(WTA)之间的差异消失。神经生理学方面的研究也发现, 富有市场经验的被试右侧岛叶(right insular)的活跃性显著低于市场经验缺乏的被试, 而当无市场经验的被试获得市场经验后, 脑岛的活跃性亦随之降低, 进一步验证了有关外在市场经验对禀赋效应的影响(郭文敏 等, 2017)。

3.5 实验情境的诱导

大量研究都验证了禀赋效应的存在, 并且发展出了不同的理论对其进行解释, 但也有学者对禀赋效应提出了质疑(Isoni, 2011; Plott & Zeiler, 2005, 2007, 2011), 他们发现在不同的实验情境下, WTA和WTP的差异并不是稳定存在的, 这个不对称现象可能受到很多情境因素的影响。比如实验的指导语上, 若主试在分配给被试禀赋产品时明确告诉被试“你现在拥有X”, 可能会使被试误解为这是主试赠与的礼物等等。该理论挑战了众多经典研究, 一经提出, 就引起了学者们的巨大关注。

Plott和Zeiler (2005)猜测, 交易不对称性的产生与被试对估值启动范式的不同理解有关。于是他们在匿名条件下使用股票估值范式, 让被试进行多轮的交易, 每轮交易后给予反馈, 最后发现WTP和WTA之间的差异消失了。Plott和Zeiler (2007)进一步控制了一些被试可能产生误解的条件, 如: 指导语的诱导性(通过抛硬币的方式随机决定被试一开始拥有的物品)、禀赋产品放置的位置(将替代产品置于被试面前)等, 结果也发现WTA和WTP之间的差异消失。他们由此提出, WTP和WTA之间的不对称不能简单地用禀赋效应来解释, 可能还受实验中没有被控制好的细节影响。而前人的研究也表明, 如果个体相信他们在一个谈判的环境中, 个体会过度地使用“卖高买低”的策略, 虚报物品的价值, 从而导致WTP和WTA差距的产生(Korobkin, 2002), 反映了实验情境对于实验结果的巨大影响。

后续有很多学者对这一理论进行了反驳, 认为禀赋效应确实是人类的内在偏好, 而并非是由于被试的误解。他们采用不同的实验范式, 控制了Plott和Zeiler (2005, 2007)提到的各种条件, 也区分了对实验范式产生了误解的被试和没有对实验范式产生误解的“精明被试”, 结果还是发现了显著的WTA与WTP之间的差距, 反驳了“被试误解说”, 证明了禀赋效应的稳定性(Bartling, Engl, & Weber, 2015; Fehr et al., 2015)。但是“被试误解说”仍然对于禀赋效应的探讨有一定的意义, 它促进了禀赋效应实验范式的规范化, 实验者在实验中会注意控制这些可能导致被试产生反应偏差的变量, 从而能更加有力地证明禀赋效应在脱离了这些变量之后也可以稳定存在(Jones, Moore, Shub, & Amitay, 2015)。

3.6 总结: 理论的整合

本文对禀赋效应及其机制解释进行了详细梳理(见图1)。起初, 研究者只围绕于损失厌恶理论, 但不久之后便有研究者意识到诸如所有权理论、认知过程、进化理论等都能对该现象进行解释(Beggan, 1992; Carmon & Ariely, 2000; Huck et al., 2005; Johnson et al., 2007; Plott & Zeiler, 2011; Weaver & Frederick, 2012)。从宏观角度, 禀赋效应是一种进化的优势, 长期利用禀赋效应在双边交换情境中获取充足资源更有利于生物体生存(Brosnan et al., 2007; Harbaugh et al., 2001)。从微观角度, 虽然损失厌恶是被最广泛采用的解释机制, 然而学者认为纯粹所有权理论(mere ownership effect)即可解释禀赋效应(Beggan, 1992; Morewedge & Giblin, 2015), 同时所有权也可被认为是损失厌恶理论的基础, 购买或售卖会参照物品的初始所有权状态, 将其作为参照点而产生的相对收益及损失的感受(Shu & Peck, 2011)。此外, 损失厌恶仅简单解释了售卖和购买所导致的损失和收益状态, 并未细致探寻个体的内在认知过程。也有研究者认为在不同的购买和售卖框架下, 个体在注意分配、记忆提取、信息搜寻等认知过程中会产生认知偏差, 这种认知偏差导致了禀赋效应(Ashby et al., 2012; Carmon & Ariely, 2000; Johnson et al., 2007; Weaver & Frederick, 2012)。同时, 虽然一些学者对禀赋效应实验范式的操纵提出了质疑, 但在反复争论中该效应仍被证实是稳定和普遍的(Isoni, 2011; Plott & Zeiler, 2005, 2007, 2011)。

4 应用: 小心机与大策略

研究者对禀赋效应内在机制的深入探索和反复争议, 既为日常生活中存在的一些反常现象寻得了合乎常理的解答, 也为进一步的应用实践提供了可能。

4.1 买家与卖家的较量: “剁手”与“洗手”

对禀赋效应解释机制的利用, 已经成为暗藏在商家销售手段背后的“小心机”, 促使一批边喊“再买就剁手”边下单的“千手观音”们的诞生。生活中消费者作为买方并未拥有商品, WTP较低, 基于“心理所有权”理论, 可以通过一些措施让消费者对商品产生所有权感知, 此时放弃购买便成为一种损失, 由于“损失厌恶”, 消费者的购买意愿提升(Kahneman & Tversky, 1979)。研究发现, 在做出购买决策前, 与商品的互动往往会影响消费者对价格的预期。这种互动主要是通过两个方面进行: 知觉到的心理所有权与情绪情感体验, 两者共同影响消费者对产品的情感联结(Shu & Peck, 2011)。

触摸是个体进行购买决策时常用的一种判断方式。过往研究发现, 增加触摸机会后, 消费者更有可能增加无计划购买行为(Peck & Childers, 2006)。而大量研究表明, 触摸能提升心理所有权(Brasel & Gips, 2014; Florack et al., 2014)。相比于口头告知拥有的方式, 触摸或者使用物体, 往往会导致个体对心理所有权的感知更为强烈。因为触摸后个体会产生暂时性的持有某件商品的感受, 即拥有控制物品的能力(Brasel & Gips, 2014)。触摸可以增加对心理所有权的感知, 但并不一定直接提升WTP。触摸体验所带来的效价, 也发挥着重要作用(Peck & Shu, 2009), 如触摸是否为顾客带来舒适的感觉。积极的体验越强烈, 放弃购买产生的损失也就越痛苦。苹果零售店就是实施这一策略的典型代表。一方面, 它注重产品的接触体验, 为顾客提供近距离商品观摩、直接触摸的机会, 提升了商品的心理所有权; 另一方面, 艺术气派的店面设计, 讲解员细致全面的讲解等给顾客带来了愉悦的体验, 二者共同作用, 提升了消费者的购买意愿。此外, 免费试用、产品定制等方式都是有效提升心理所有权的手段(Walasek, Rakow, & Matthews, 2017)。这些方式通过顾客与商品之间的亲密互动, 逐渐将自我概念投射到商品中, 从而增强心理所有权, 促进产品销售。

对于消费者而言, 在知晓禀赋效应后对购买决策需要更加谨慎。早在2003年, 美国伊利诺伊州总检察长办公室就对购物者发出一条警告: 警惕那些鼓励持有商品并想象该物品为自己所有的商家(Peck & Shu, 2009)。在了解心理所有权对禀赋效应的影响后, 我们可以反其道而行之。例如, 洗手这一物理动作可以重置我们的认知系统, 进而减少由于拥有或者不拥有商品所带来的认知不平衡, 即洗手能够减少由所有权导致的决策偏差(Florack et al., 2014)。因此, 当参与商品体验中无法自拔时, 不如及时去洗个手吧。

4.2 政策建议与应用: 巧搬钉子户

在中国的城市化进程中, 由于征地和拆迁所引发的群体事件时常发生, 而征地和拆迁中的最主要矛盾来自于政府的WTP和拆迁户的WTA之间的鸿沟。政府根据市价对拆迁户进行补偿, 但拆迁户对住所的估值除了基础的市价外, 还受到禀赋效应影响, 出价通常高于市价。其中的一个原因是居所和土地与一般物品不同, 基于Radin (1982)提出的人格财产这一概念, 居所对个体的意义远高于一般的具有可替代性的个人所有物, 居所与个体的人格紧密联系, 是个体自我延伸的人格财产, 因此个体在此类物品上会表现出较强的禀赋效应。这在中国学者的实证研究中也得到了同样的验证, 据罗必良(2014)对广东省7个乡镇的调查, 农户的WTP/WTA比率均高于1。另外, 有15.87%的农户宁愿闲置土地也不愿意流转, 这类农户的禀赋效应高达14.69。吴诗嫚、杨钢桥和赵微(2015)的研究中也发现, 房屋拆迁的WTA与WTP的比率为2.11, 耕地占用的比率为3.05, 个体面对耕地和房屋的损失存在明显的禀赋效应, 而纯粹的经济损失, 如树木损毁和青苗压占等则不存在禀赋效应。因此政府在征地和协商谈判的过程中必须意识到, 住户的居所和土地并不是一般的可替代财产, 要对住户的产权给予足够尊重。

此外, Thaler (2015)提出, 禀赋效应还会影响个体的公平感知, 个体通常将现状作为参照点界定公平, 那么若情况变化后不如现状, 个体便会将其感知为不公平, 并可能产生一些反抗行为。因此, 政府在征地过程中要以协商谈判为主, 严格依法行事, 保证程序公平、提升互动公平, 从而削弱个体感知到的结果不公平, 降低感受到的不公平感, 避免极端事件发生。另外, 基于心理所有权理论(Heider, 1958), 物品拥有的时间、接触会提升所有感, 进而提升WTP (Brasel & Gips, 2014; Strahilevitz & Loewenstein, 1998)。因此政府可以通过提前将安置房借给住户试住, 当拆迁户入住一段时间后, 对各方面条件都更好的新居产生所有感, 离开新居可能产生损失厌恶, 同时指向原有住所的所有权被削弱, 此时再与拆迁户进行拆迁赔偿谈判, 协商一致的可能性大大提高。

总之, 禀赋效用对人们的生活具有重要影响, 从国家政策层面有利于“助推”社会的稳定和发展, 从商业层面也已被广泛应用于方方面面。同时从消费者自身出发, 了解与学习禀赋效应有利于巧妙应对商家的“小心机”, 做出理性的消费决策。

5 总结与展望

基于对生活中反常现象的观察和思考, 塞勒开拓性地提出禀赋效应, 本文从心理学的角度对其解释机制的主要理论进行梳理(见图1), 深入探讨了理论间的联系和差异, 并总结了禀赋效应在生活中的应用。

同时我们注意到, 也有研究者对禀赋效应提出了质疑(见①: “情景诱导”与“客观事实”之争), 认为WTA/WTP差异并不是拥有本身对价值评估产生的影响, 而是被试对实验情境的一个错误反应(Plott & Zeiler, 2005, 2007)。这也激励着拥护者们从各种方面寻找禀赋效应存在的证据和原因, 诸如风险厌恶、心理所有权、偏差的认知过程以及进化等理论, 从微观、宏观等不同角度论证禀赋效应是一种固有的内在偏好。随着技术进步, 研究者也不仅仅依赖于行为实验(Morewedge et al., 2009), 还通过眼动(Ashby et al., 2012)、脑电(Huang & Wu, 2016)和功能性核磁功能成像(de Martino et al., 2009)等实验指标进行验证。同时, 一些元分析研究也在整合大量研究的基础上为禀赋效应的稳定性和普遍性提供了证据(Tunçel & Hammitt, 2014; Yechiam, Ashby, & Pachur, 2017)。各个理论之间的相互佐证与辩驳也不断验证了禀赋效应的普遍性和稳定性, 这些质疑之声对禀赋效应实验范式的规范化提出了更高的要求, 为其进一步发展提供了努力方向。

此外, 关于禀赋效应是源于先天还是后天的争论也从未停息(见②: “本能说”与“习得说”之争)。“本能说”的支持者认为, 禀赋效应诞生于漫长的进化过程, 是各种机制优胜劣汰的结果。研究者们在黑猩猩(Brosnan et al., 2007)、卷尾猴(Lakshminaryanan et al., 2008)等类人生物以及具有较少市场交易经验的5岁儿童(Harbaugh et al., 2001)身上发现了禀赋效应。“习得说”的支持者则认为禀赋效应是人们在市场环境中不断学习的产物(List, 2003; Plott & Zeiler, 2005; Shogren et al., 1994)。除了直接学习, 在评价商品时提取有关信息的过程也是积累得到的, 而这一提取过程又有不同的来源。参照价格理论建立在外部环境搜索基础上, 这种外部搜索得到的不同结果, 可能导致个体对物体价值不同的感知, 进而催生禀赋效应(Simonson & Drolet, 2004)。总之, 关于禀赋效应是先天遗传还是后天形成的争论仍在进行, 需要通过未来更多的研究证据来验证。

虽然禀赋效应的研究不胜枚举, 但我们认为未来的研究者无论在理论探索、应用性研究还是基于中国国情的研究等方面仍大有可为。

首先, 禀赋效应是否还存在其它可能的解释?例如, 有研究者提出预期后悔理论, 即决策者预期未来可能为当前决策后悔, 预期后悔会影响决策者之后的选择(Ahn, Kim, & Aggarwal, 2014)。研究发现, 在进行交易时, 对损失的消极预期会阻止个体接下来的行动; 因此买方倾向于提供较低价格避免后悔、而卖方提供较高价格以避免后悔(Zhang & Fishbach, 2005)。因此, 情绪也可能解释禀赋效应。此外, 本文对偏差的认知过程只整合了注意、记忆、信息搜索等认知方式, 是否还存在其他的认知过程偏差, 需要未来的研究者进一步探究。最后, 还需要关注个体差异对禀赋效应的影响, 有研究发现, 相比于满意型决策者, 最优化决策者在决策中精益求精, 力求获得最优结果(朱冬青, 谢晓非, 2013)。那么最优化倾向强的个体是否更容易出现这种决策偏差?综上, 未来的研究可以从情绪、认知、个体差异等多角度入手不断完善和丰富现有理论体系。

其次, 禀赋效应的发现来源于塞勒对实际生活中的非理性行为现象的观察, 该效应对于帮助解决政策问题、促进商家销售方面具有重要价值。但在现实中, 对禀赋效应的相关研究大都重理论, 轻应用。未来心理学研究者应该增加现象验证和应用拓展, 注重同政府或相关组织的合作, 对一些现实问题例如合理有效拆迁等给出切实有效的行为干预方案, 优化人们的生活, 提高研究的价值。此外, 对禀赋效用的利用主要集中于心理所有权和损失厌恶理论的结合。可能的原因是, 基于双系统理论(Kahneman, 2003), 个体有两种不同的认知加工过程, 一种是无意识的、自动的过程(即系统1), 另一种是有意识的, 需要付出努力进行自我控制的过程(即系统2)。心理所有权可以利用个体的系统1, 通过一些较为简单、低成本、符合人们认知惯性的行为(如: 触摸、洗手)即可实现(Brasel & Gips, 2014; Florack et al., 2014), 相反对认知过程的改变等则需通过系统2, 需要个体付出认知努力(Johnson et al., 2007)。因此未来研究可以秉承塞勒的助推思想, 广泛利用禀赋效应的相关理论, 通过巧妙的措施引导个体做出更好的决策, 提升个体的健康、财富和幸福水平。

最后, 通过梳理我们发现, 国内研究者在禀赋效应理论拓展、方法更新和影响因素探究等方面均有所贡献。在理论方面, 一些研究者拓展了心理所有权对禀赋效应的解释(Feng et al., 2013; Huang & Wu, 2016; Zhao et al., 2014); 在研究方法上, 我国学者也紧跟学术潮流, 采用了最新的技术手段进行研究(Feng et al., 2013; Huang & Wu, 2016; Zhao et al., 2014); 对于影响因素, 如时间压力、情绪、社会价值导向等都有涉猎(Lin, Chuang, Kao, & Kung, 2006; Lin & Lin, 2006; Sun, 2011); 此外, 在心理学及经济学领域也出现了大量的综述著作(郭文敏 等, 2017; 连洪泉, 董志强, 张沛康, 2016; 刘腾飞, 徐富明, 张军伟, 蒋多, 陈雪玲, 2010; 赵伟华, 索涛, 冯廷勇, 李红, 2010)。这些总结有助于激发后续研究者对禀赋效应的研究兴趣。未来国内研究者可以更多地基于中国独特的国情, 探寻禀赋效应可能存在的文化差异及其在中国国情生活中的具体体现, 不断拓展禀赋效应的理论体系, 并为解决中国的现实问题诸如“拆迁难”、“招工难”等重大社会问题发挥作用。

参考文献

作为异质性偏好的禀赋效应: 来自神经经济学的证据

禀赋效应是主流经济学难以回避的“异象”(Anomalies),对主流经济学一系列重要的理论假设构成了严峻挑战。过去半个世纪以来,对于禀赋效应是否真实、有效和稳健的存在,在主流经济学家与行为经济学家和实验经济学家之间一直存在着严重的分歧与争论。近10年来,伴随着科学技术的进步以及脑科学、认知神经科学、尤其是神经经济学的发展,研究者们在行为实验的基础上,使用脑成像和脑刺激等先进技术,揭示了禀赋效应与人类大脑神经活动之间的相关关系和因果关系,在神经科学的层面上证实了禀赋效应存在的微观基础。文章将对这些研究成果进行较为全面的回顾与评述,从而为禀赋效应的存在性提供新的科学证据。

禀赋效应对产品更换决策的影响

DOI:10.3724/SP.J.1041.2009.00737

URL

[本文引用: 1]

以禀赋效应理论为研究基础,通过两个情景实验对产品更换过程中买卖双方的决策心理进行了研究。实验1表明,在以旧换新活动中新产品的买方对旧产品的价格有高估的倾向,对新产品的价格有低估的倾向;相反,新产品的卖方对旧产品的价格有低估的倾向,而对于新产品的价格有高估的倾向,这说明产品更换决策中存在着双重的禀赋效应。实验2表明,新产品的买方对旧产品的属性评价显著高于新产品的卖方,对新产品的属性评价显著低于新产品的卖方,说明属性评价也存在禀赋效应的特征。双重禀赋效应的存在从消费者行为的角度解释了为什么消费者会出现创新抵制行为。

禀赋效应的行为和实验经济学研究进展

DOI:10.3969/j.issn.1000-6249.2016.11.006

URL

[本文引用: 1]

禀赋效应是指拥有某物品的人们对某物品的评价,比不拥有该物品品的人对该物品的评价要高得多。大量的行为实验研究表明,禀赋效应是人类行为的固有倾向,而非诱导的偏好。文章概述交换范式和估值范式这两种不同测度方式的禀赋效应早期实验研究,禀赋效应稳定性、普遍性和微观偏好基础的扩展实验研究,以及最新的关于禀赋效应究竟是源于被试误解还是客观事实的最新实验进展。在此基础上,文章展望了禀赋效应行为经济研究的未来方向。

禀赋效应的心理机制及其影响因素

Endowment effect refers to a phenomenon that people sometimes demand much more to give up an object of their own than they are, or would ever be, willing to pay to acquire the very same object. This phenomenon is universal in behavioral economics. This paper introduced the concepts and research paradigms of endowment effects, including the classical paradigm and barter trade paradigm, and elaborated two psychological mechanism of endowment effect, namely, loss aversion and query theory. Then the paper came to some influential factors of endowment effect, including motivation, emotions, object character, and study design characteristics. Finally, the issues deserved further research were also outlined, such as the origin and applied conditions of endowment effect.

农地流转的市场逻辑——“产权强度-禀赋效应-交易装置”的分析线索及案例研究

DOI:10.3969/j.issn.1000-6249.2014.05.001

URL

[本文引用: 1]

农户普遍存在的禀赋效应,因土地人格化财产特征的强化,而成为抑制农地流转的重要根源。农地流转并不是一个纯粹的要素市场,而是包含了地缘、亲缘、人情关系在内的特殊市场,有其特殊的市场逻辑。推进农地的流转及其规模化经营,需要针对产权主体与产权客体不可分的交易约束,进行相应交易装置的选择与匹配。基于"产权强度-禀赋效应-交易装置"的分析线索,本文拓展了科斯定理。文章进一步对四川省崇州市的"农业共营制"进行了案例剖析。作者认为,以土地"集体所有、家庭承包、多元经营、管住用途"为主线的制度内核,将成为我国新型农业经营体系的基本架构。

农地整治项目农户利益损失补偿研究——基于禀赋效应理论的实证分析

DOI:10.11994/zgtdkx.2015.11.002

URL

[本文引用: 1]

研究目的:揭示农户利益损失的内在行为机理,为农地整治项目利益损失补偿机制的构建奠定理论基础。研究方法:运用禀赋效应理论提出农户利益损失内在行为机理的理论假说,并以湖北省部分县市340份农户问卷为样本,采用定序回归模型,分析农户对耕地被占用禀赋效应的影响因素。研究结果:农地整治过程中农户存在经济损失和主观损失,青苗压占、林木损毁、田块分割只存在经济损失,为补偿价值与市场价值的差值;房屋拆迁、坟墓迁移和耕地占用经济损失和主观损失并存,主观损失源于禀赋效应引起的农户主观价值和市场价值的认知差异。研究结论:不具有禀赋效应的物品发生损失时,应根据物品的市场价格进行补偿;具有禀赋效应的物品发生损失时,应根据禀赋效应的强弱对不同性质财产实行差别化的补偿策略,同时,也应避免过高的禀赋效应对要素的正常流动带来负面的影响,才能保护农户的利益,促进项目的顺利实施。

禀赋效应的研究现状与展望

禀赋效应是指一旦某物品成为自己拥有的一部分,人们倾向给予它更高的价值评价。对于禀赋效应的解释主要是损失规避理论和自尊理论。影响禀赋效应产生的因素主要有物品价格的不确定性、好奇心效应、交易需求效应等。神经机制研究表明,内侧前额叶(MPFC)、伏隔核(NAcc)、岛叶(insula)等脑区与禀赋效应密切相关,神经机制研究为全面理解禀赋效应提供了新的途径。

最优化与满意型决策风格孰优孰劣?

DOI:10.3724/SP.J.1042.2013.00309

URL

[本文引用: 1]

The maximizers are more likely to pursue optimal solutions, while the satisficers prefer to seek satisfied ones. Based on Rational Choice Theory and The Bounded Rationality Model, the previous studies proposed the maximizing and satisficing styles and thus compared the two groups of decision-makers on their decision-making features and psychological indexes. With regards to pure economic effectiveness, subjective psychological meanings and practical decision-making choices, the question of ‘which one is better between these two decision-making styles’ differs on individuals and decision-making targets. The future studies could focus on improving measuring tools basing on a clear distinction of those two decision-making styles. And then the domain specificity, the relationship between the two styles and the positive emotions and the origin of psychological paradox could be further explored.

Helping fellow beings: Anthropomorphized social causes and the role of anticipatory guilt

DOI:10.1177/0956797613496823 URL [本文引用: 1]

Good self, bad self: Initial success and failure moderate the endowment effect

DOI:10.1016/j.joep.2015.07.002

URL

[本文引用: 1]

Recent research on the endowment effect (a gap between selling and buying prices for the same good) considers as a working hypothesis that an endowed good becomes part of the self. Consequently, the endowment effect is viewed as a self-enhancement strategy originating or following from this self-object link. Within this perspective, subsequent self-threat typically enhances the endowment effect, whereas self-affirmation eliminates the endowment effect. Contrasting these findings and drawing on the idea that initial self-evaluations constrain the value of a newly acquired object, we reasoned that failures (successes) of the self experienced before the endowment will lower (raise) the value of possessions and influence the endowment effect accordingly. In Studies 1 and 2, we show that a private self-threat (vs. no threat) induced before endowing (vs. presenting) participants with a good eliminates the endowment effect. In Study 3, we show that feelings of pride (vs. no pride) induced via proprioceptive feedback yields a reliable endowment effect. These findings suggest that initial self-success/failure moderate the endowment effect and further show that bodily cues influence property transaction.

Evolutionary origins of the endowment effect: Evidence from hunter-gatherers

DOI:10.2139/ssrn.2255650

URL

[本文引用: 1]

The endowment effect, the tendency to value possessions more than non-possessions, is a well known departure from rational choice and has been replicated in numerous settings. We investigate the universality of the endowment effect, its evolutionary significance, and its dependence on environmental factors. We experimentally test for the endowment effect in an isolated and evolutionarily relevant population of hunter-gatherers, the Hadza Bushmen of Northern Tanzania. We find that Hadza living in isolated regions do not display the endowment effect, while Hadza living in a geographic region with increased exposure to modern society and markets do display the endowment effect.

Cortical midline structures and autobiographical-self processes: An activation-likelihood estimation meta-analysis

DOI:10.3389/fnhum.2013.00548

URL

PMID:3762365

[本文引用: 1]

The autobiographical-self refers to a mental state derived from the retrieval and assembly of memories regarding one’s biography. The process of retrieval and assembly, which can focus on biographical facts or personality traits or some combination thereof, is likely to vary according to the domain chosen for an experiment. To date, the investigation of the neural basis of this process has largely focused on the domain of personality traits using paradigms that contrasted the evaluation of one’s traits (self-traits) with those of another person’s (other-traits). This has led to the suggestion that cortical midline structures (CMSs) are specifically related to self states. Here, with the goal of testing this suggestion, we conducted activation-likelihood estimation (ALE) meta-analyses based on data from 28 neuroimaging studies. The ALE results show that both self-traits and other-traits engage CMSs; however, the engagement of medial prefrontal cortex is greater for self-traits than for other-traits, while the posteromedial cortex is more engaged for other-traits than for self-traits. These findings suggest that the involvement CMSs is not specific to the evaluation of one’s own traits, but also occurs during the evaluation of another person’s traits.

Focusing on what you own: Biased information uptake due to ownership

DOI:10.1016/j.jml.2012.03.004

URL

[本文引用: 5]

The endowment effect has been debated for over 30 years. Recent research suggests that differential focus of attention might play a role in shaping preferences. In two studies we investigated the role of biased attention in the emergence of endowment effects. We thereby derive predictions from an extended version of evidence accumulation models by additionally assuming a bias in attentional allocation based on ones endowment status. We test these predictions against an alternative account in which the endowment effect is the result of initial anchoring and adjustment differences (Sequential Value Matching model; Johnson and Busemeyer, 2005). In both studies we add deliberation time constraints to a standard Willingness-to-Accept/Willingness-to-Pay paradigm and consistently find that the endowment effect grows as deliberation time increases. In Study 2 we additionally use eye tracking and find that buyers focus more on value decreasing attributes than sellers (and vice versa for value increasing attributes). This shift in attention plays a pivotal role in the construction of value and partially mediates the endowment effect.

Game form misconceptions are not necessary for a willingness-to-pay vs. willingness-to-accept gap

DOI:10.1007/s40881-015-0008-0

URL

[本文引用: 1]

Cason and Plott (J Polit Econ, 122(6):1235–1270, 2014) show that subjects’ misconception about the incentive properties of the Becker-DeGroot-Marschak (BDM) value elicitation procedure can generate...

On the social nature of nonsocial perception: The mere ownership effect

DOI:10.1037/0022-3514.62.2.229

URL

[本文引用: 7]

Abstract Assumes that ownership of an object causes the owner to treat the object as a social entity because ownership creates a psychological association between the object and the owner. Three experiments investigated whether Ss would evaluate an object more favorably merely because they owned it, a bias analogous to other self-serving biases people display. Study 1 confirmed the existence of this mere ownership effect. Study 2 showed that the effect was not due to Ss having greater exposure to an owned object relative to an unowned object. Study 3 showed that the effect may be a specific instance of a general tendency of people to make self-enchancing judgments. (PsycINFO Database Record (c) 2012 APA, all rights reserved)

Tablets, touchscreens, and touchpads: How varying touch interfaces trigger psychological ownership and endowment

DOI:10.1016/j.jcps.2013.10.003

URL

[本文引用: 5]

As mouse-driven desktop computers give way to touchpad laptops and touchscreen tablets, the role of touch in online consumer behavior has become increasingly important. This work presents initial explorations into the effects of varying touch-based interfaces on consumers, and argues that research into the interfaces used to access content can be as important as research into the content itself. Two laboratory studies using a variety of touch technologies explore how touchscreen interfaces can increase perceived psychological ownership, and this in turn magnifies the endowment effect. Touch interfaces also interact with importance of product haptics and actual interface ownership in their effects on perceived product ownership, with stronger effects for products high in haptic importance and interfaces that are owned. Results highlight that perceptions of online products and marketing activities are filtered through the lens of the interfaces used to explore them, and touch-based devices like tablets can lead to higher product valuations when compared to traditional computers.

A comparative analysis of reference price models

DOI:10.1086/209505

URL

[本文引用: 1]

The effect of reference price on brand choice decisions has been well documented in the literature. Researchers, however, have differed in their conceptualizations and, therefore, in their modeling of reference price. In this article, we evaluate five alternative models of reference price of which two arestimulus based(i.e., based on information available at the point‐of‐purchase) and three that arememory based(i.e., based on price history and/or other contextual factors). We calibrate the models using scanner panel data for peanut butter, liquid detergent, ground coffee, and tissue. To account for heterogeneity in model parameters, we employ a latent class approach and select the best segmentation scheme for each model. The best model of reference price is then selected on the basis of fit and prediction, as well as on the basis of parsimony in cases where the fits of the models are not very different. In all four categories, we find that the best reference price model is a memory‐based model, namely, one that is based on the brand's own price history. In the liquid detergent category, however, we find that one of the stimulus‐based models, namely, the current price of a previously chosen brand, also performs fairly well. We discuss the implications of these findings.

Endowment effects in chimpanzees

DOI:10.1016/j.cub.2007.08.059 URL [本文引用: 4]

Loss aversion without the endowment effect, and other explanations for the WTA-WTP disparity

DOI:10.1016/j.jebo.2003.10.010

URL

[本文引用: 1]

To learn why WTA regularly exceeds WTP in economic experiments involving inexpensive market goods with ample substitutes, the verbal protocol technique was used in a real cash experiment employing a random price auction. Results suggest that the primary reason for the disparity was subjects鈥 reluctance to suffer a net loss from any transaction, whether purchase or sale, and tendency to consider sale much below assumed market price as a loss. This interpretation indicates a kind of loss aversion, but not the kind envisioned in the endowment effect, which maintains that selling creates a loss and buying creates a gain.

Three cheers--psychological, theoretical, empirical--for loss aversion

DOI:10.1509/jmkr.42.2.129.62286

URL

[本文引用: 1]

This note emphasizes the special role of prospect theory in drawing psychophysical considerations into theories of decision making with respect to risk. An example of such a consideration is the dependence of outcome value on a reference point and the increased sensitivity of loss relative to gain (i.e., loss aversion). Loss aversion can explain the St. Petersburg paradox without requiring concave utility, it has the correct psychological foundation, it is theoretically useful, and it is a parsimonious principle that can explain many puzzles. A few open questions are whether loss aversion is a stable feature of preference, whether it is an expression of fear, and what are its properties.

Focusing on the forgone: How value can appear so different to buyers and sellers

DOI:10.1086/317590 URL [本文引用: 5]

The endowment effect as self-enhancement in response to threat

DOI:10.1086/671344 URL [本文引用: 5]

How basic are behavioral biases? Evidence from capuchin monkey trading behavior

DOI:10.1086/503550

URL

[本文引用: 1]

Behavioral economics has demonstrated systematic decision‐making biases in both lab and field data. Do these biases extend across contexts, cultures, or even species? We investigate this question by introducing fiat currency and trade to a colony of capuchin monkeys and recovering their preferences over a range of goods and gambles. We show that capuchins react rationally to both price and wealth shocks but display several hallmark biases when faced with gambles, including reference dependence and loss aversion. Given our capuchins’ inexperience with money and trade, these results suggest that loss aversion extends beyond humans and may be innate rather than learned.

The neurobiology of reference-dependent value computation

DOI:10.1016/S1053-8119(09)71082-1

URL

PMID:19321780

[本文引用: 2]

A key focus of current research in neuroeconomics concerns how the human brain computes value. Although, value has generally been viewed as an absolute measure (e.g., expected value, reward magnitude), much evidence suggests that value is more often computed with respect to a changing reference point, rather than in isolation. Here, we present the results of a study aimed to dissociate brain regions involved in reference-independent (i.e., "absolute") value computations, from those involved in value computations relative to a reference point. During functional magnetic resonance imaging, subjects acted as buyers and sellers during a market exchange of lottery tickets. At a behavioral level, we demonstrate that subjects systematically accorded a higher value to objects they owned relative to those they did not, an effect that results from a shift in reference point (i.e., status quo bias or endowment effect). Our results show that activity in orbitofrontal cortex and dorsal striatum track parameters such as the expected value of lottery tickets indicating the computation of reference-independent value. In contrast, activity in ventral striatum indexed the degree to which stated prices, at a within-subjects and between-subjects level, were distorted with respect to a reference point. The findings speak to the neurobiological underpinnings of reference dependency during real market value computations.

Can acetaminophen reduce the pain of decision-making?

DOI:10.1016/j.jesp.2014.09.006

URL

[本文引用: 1]

Psychological and behavioral economic theories have shown that people often make irrational and suboptimal decisions. To describe certain decisions, people often use words related to pain ("hurt," "painful"). Neuroscientific evidence suggests common overlap between systems involved in physical pain and decision-making. Yet no prior studies have explored whether a pharmacological intervention aimed at reducing physical pain could reduce the pain of decision-making. The current investigation filled this gap by assigning participants to consume the physical painkiller acetaminophen or placebo and then exposing them to situations known to produce cognitive dissonance (Experiment 1) or loss aversion (Experiment 2). Both experiments showed that acetaminophen reduced the pain of decision-making, as indicated by lower attitude change that accompanies cognitive dissonance and lower selling prices when selling personal possessions. (C) 2014 Elsevier Inc. All rights reserved.

Explaining the endowment effect through ownership: The role of identity, gender, and self-threat

DOI:10.1086/666737 URL [本文引用: 4]

Endowment effects in gorillas (gorilla gorilla)

DOI:10.1037/a0031902

URL

PMID:24060245

[本文引用: 1]

Reports of endowment effects in nonhuman primates have received considerable attention in the comparative literature in recent years. However, little is known about the mechanisms underlying these effects. Continuing to explore endowment effects across different species of primate may reveal subtle differences in behavior that can help formulate specific hypotheses about the relevant mechanisms and the social and ecological factors that have shaped them. In this study, we use a paradigm that has previously been used to test chimpanzees (Pan troglodytes) and orangutans (Pongo spp.) to explore whether western lowland gorillas (Gorilla gorilla) exhibit comparable endowment effects. We find that gorillas exhibit endowment effects when in possession of food, but not nonfood, items, and that they show a statistically stronger effect than chimpanzees but not orangutans. These findings are consistent with the hypothesis that mechanisms for endowment effects in primates may be related to inhibitory control or risk aversion.

Reconsidering the effect of market experience on the "endowment effect"

DOI:10.3982/ECTA8424

URL

[本文引用: 1]

Simple exchange experiments have revealed that participants trade their endowment less frequently than standard demand theory would predict. List (2003a) found that the most experienced dealers acting in a well functioning market are not subject to this exchange asymmetry, suggesting that a significant amount of market experience is required to overcome it. To understand this market-experience effect, we introduce a distinction between two types of uncertainty090000choice uncertainty and trade uncertainty090000both of which could lead to exchange asymmetry. We conjecture that trade uncertainty is most important for exchange asymmetry. To test this conjecture, we design an experiment where the two treatments impact differently on trade uncertainty, while controlling for choice uncertainty. Supporting our conjecture, we find that 090008forcing090009 subjects to give away their endowment in a series of exchanges eliminates exchange asymmetry in a subsequent test. We discuss why markets might not provide sufficient incentives for learning to overcome exchange asymmetry.

Expectations as endowments: Evidence on reference-dependent preferences from exchange and valuation experiments

DOI:10.2139/ssrn.1505121

URL

[本文引用: 1]

While evidence suggests that people evaluate outcomes with respect to reference points, little is known about what determines them. We conduct two experiments that show that reference points are determined, at least in part, by expectations. In an exchange experiment, we endow subjects with an item and randomize the probability they will be allowed to trade. Subjects that are less likely to be able to trade are more likely to choose to keep their item. In a valuation experiment, we randomly assign subjects a high or low probability of obtaining an item and elicit their willingness-to-accept for it. The high probability treatment increases valuation of the item by 20--30%. Copyright 2011, Oxford University Press.

The endowment effect

The willingness to pay - willingness to accept gap: A failed replication of plott and zeiler

DOI:10.1016/j.euroecorev.2015.05.006

URL

[本文引用: 2]

The well-known willingness to pay–willingness to accept (WTP–WTA) gap refers to the observation that individuals attach a higher value to objects they own (WTA) than to objects they do not own (WTP). We report on experiments to re-investigate the possibility that the WTP–WTA gap arises from subject misconceptions due to experimental procedures as suggested by Plott and Zeiler (2005). The contribution of this paper is two-fold: first, we attempt to replicate the findings by Plott and Zeiler that the WTP–WTA gap disappears when using procedures that are aimed at reducing misconceptions, such as extensive training and practice rounds for the BDM mechanism. However, we fail to do so as the WTP–WTA gap persists in the main task where subjects state their WTA or WTP for a mug. Second, we use the paid practice rounds to identify subjects without apparent misconceptions and find that also for those subjects who never make dominated choices in the lottery tasks, the WTP–WTA gap in the mug task exists. Thus, we find no evidence of the idea that subject misconceptions are the main source of the WTP–WTA gap.

The endowment effect can extend from self to mother: Evidence from an fMRI study

DOI:10.1016/j.bbr.2013.04.005

URL

PMID:23588273

[本文引用: 3]

People typically demand more to part with goods they own than they would be willing to pay to acquire identical goods they do not own, a phenomenon known as the endowment effect [1–3]. Recently, a large body of behavioral research has suggested that the endowment effect may actually be a type of self-referent cognitive bias resulting from ownership of an object. However, the neural underpinnings of this effect are not well understood. In the present study, we used functional magnetic resonance imaging (fMRI) to explore whether brain activity can predict the extensibility of the endowment effect to items owned by another individual with a close relationship to the subject. Subjects were asked to decide whether to buy or sell their own or their mothers’ possessions at various prices. Behavioral results showed an endowment effect not only for goods owned by the subjects, but also for goods owned by the subjects’ mothers, providing evidence for the extensibility of the endowment effect. Neuroimaging data showed activation in the medial prefrontal cortex (MPFC) and insula in both ownership conditions. Also, MPFC activation was positively correlated with the behavioral indifference point in the sell-for-self and sell-for-mother conditions. Furthermore, psychophysiological interaction (PPI) analysis revealed that MPFC activation was accompanied by increased functional integration with insula and striatum. Together, these findings suggest that MPFC may play an important role in the extensibility of the endowment effect.

Detaching the ties of ownership: The effects of hand washing on the exchange of endowed products

DOI:10.1016/j.jcps.2013.09.010

URL

[本文引用: 5]

Recent studies have demonstrated that the ownership of a product leads to a biased perception of its aspects. Based on research on embodied cognition, we argue that the physical action of hand washing can reset the cognitive system to a more neutral state by reducing the asymmetrical perception of owned and not owned products. In three studies, we examined the effects of hand washing on the endowment effect by asking owners of a product to exchange it for a similar one. As expected, in Experiment 1, we showed that hand washing doubled the percentage of participants who exchanged an owned product for an alternative product. In Experiment 2, we replicated this finding and showed that only the action of hand washing and not a prime of physical cleaning elicited this effect. In Experiment 3, we again replicated the hand washing effect on exchange rates and examined the effect of hand washing on product evaluations. The results of all experiments suggest that hand washing reduces decision preferences that are biased by ownership.

Are adults better behaved than children? Age, experience, and the endowment effect

DOI:10.1016/S0165-1765(00)00359-1

URL

[本文引用: 3]

We find that large increases in age do not reduce the endowment effect, supporting the hypothesis that people have reference-dependent preferences which are not changed by repeated experience getting and giving up goods.

Social perception of self-enhancement bias and error

DOI:10.1027/1864-9335/a000287

URL

[本文引用: 1]

Abstract: How do social observers perceive and judge individuals who self-enhance (vs. not)? Using a decision-theoretic framework, we distinguish between self-enhancement bias and error, where the former comprises both correct and incorrect self-perceptions of being better than average. The latter occurs when a claim to be better than others is found to be false. In two studies, we find that when judging people's competence, observers are sensitive to the accuracy of self-perception. When judging their morality, however, they tend to respond negatively to any claims of being better than average. These findings are further modulated by the domain of performance (intelligence vs. moral aptitude). Implications for the strategic use of self-enhancement claims are discussed.

Picture yourself: Self-focus and the endowment effect in preschool children

DOI:10.1016/j.cognition.2016.03.019

URL

PMID:27035610

[本文引用: 2]

When an object comes into possession, the owner will typically think that it is worth more than it did before they owned the item in a bias known as the endowment effect. This bias is particularly robust in Western societies with independent self-construals, but has not been observed in children below 5–6years of age. In three studies, we investigated whether endowment effect can be induced in younger children by focusing their attention on themselves. 120 children aged 3–4years evaluated toys before and after a task where they made pictures of themselves, a friend or a neutral farm scene. Over the three studies, children consistently evaluated their own possessions, relative to other identical toys, more positively following the self-priming manipulation. Together these studies support the notion that possessions can form part of an “extended self” from early on in development and that the endowment effect may be due to an attentional self-bias framing.

Ownership effect can be a result of other-derogation: Evidence from behavioral and electrophysiological studies

DOI:10.1371/journal.pone.0166054

URL

PMID:5096666

[本文引用: 4]

Growing evidence suggests that people overvalue their own objects compared to those owned by others, even when the two objects are virtually identical (i.e., ownership effect). Most researchers seem to consider self-enhancement as the underlying mechanism while neglecting the possible process of other-derogation. Here, we attempted to compare these two perspectives, adopting both implicit and neurocognitive methodologies to overcome social desirability confounds. In Study 1, we found that the ownership effect (measured by Implicit Association Test), was correlated with other-derogation but not with self-enhancement (both measured by the Go/No-Go Association Task). In Study 2, by using the event-related potentials (ERPs) technique, we showed that positive-framed other-owned objects elicited significant evaluative incongruity (i.e. indexed by late positive potentials) compared to negative-framed other-owned objects. In contrast, negative-framed self-owned objects did not evoke significant evaluative incongruity relative to positive-framed self-owned objects. Our research suggests that, in addition to the self-enhancement that has been widely demonstrated, it is also important to keep other-derogation in mind when examining the ownership effect.

Learning to like what you have: Explaining the endowment effect

DOI:10.1111/j.1468-0297.2005.01015.x

URL

[本文引用: 3]

http://www.jstor.org/stable/3590453

The willingness-to-accept/willingness-to-pay disparity in repeated markets: Loss aversion or ‘bad-deal’ aversion?

DOI:10.1007/s11238-010-9207-6

URL

[本文引用: 2]

Several experimental studies have reported that an otherwise robust regularity-the disparity between Willingness-To-Accept and Willingness-To-Pay-tends to be greatly reduced in repeated markets, posing a serious challenge to existing reference- dependent and reference- independent models alike. This article offers a new account of the evidence, based on the assumptions that individuals are affected by good and bad deals relative to the expected transaction price ( price sensitivity), with bad deals having a larger impact on their utility ( `bad-deal' aversion). These features of preferences explain the existing evidence better than alternative approaches, including the most recent developments of loss aversion models.

Aspects of endowment: A query theory of value construction

DOI:10.1037/0278-7393.33.3.461

URL

PMID:17470000

[本文引用: 8]

Abstract How do people judge the monetary value of objects? One clue is provided by the typical endowment study (D. Kahneman, J. L. Knetsch, & R. H. Thaler, 1991), in which participants are randomly given either a good, such as a coffee mug, that they may later sell ("sellers") or a choice between the good and amounts of cash ("choosers"). Sellers typically demand at least twice as much as choosers, inconsistent with economic theory. This result is usually explained by an increased weighting of losses, or loss aversion. The authors provide a memory-based account of endowment, suggesting that people construct values by posing a series of queries whose order differs for sellers and choosers. Because of output interference, these queries retrieve different aspects of the object and the medium of exchange, producing different valuations. The authors show that the content and structure of the recalled aspects differ for selling and choosing and that these aspects predict valuations. Merely altering the order in which queries are posed can eliminate the endowment effect, and changing the order of queries can produce endowment-like effects without ownership.

The role of response bias in perceptual learning

DOI:10.1037/xlm0000111

URL

PMID:4562609

[本文引用: 1]

Sensory judgments improve with practice. Such perceptual learning is often thought to reflect an increase in perceptual sensitivity. However, it may also represent a decrease in response bias, with unpracticed observers acting in part on a priori hunches rather than sensory evidence. To examine whether this is the case, 55 observers practiced making a basic auditory judgment (yes/no amplitude-modulation detection or forced-choice frequency/amplitude discrimination) over multiple days. With all tasks, bias was present initially, but decreased with practice. Notably, this was the case even on supposedly ias-free, 2-alternative forced-choice, tasks. In those tasks, observers did not favor the same response throughout (stationary bias), but did favor whichever response had been correct on previous trials (nonstationary bias). Means of correcting for bias are described. When applied, these showed that at least 13% of perceptual learning on a forced-choice task was due to reduction in bias. In other situations, changes in bias were shown to obscure the true extent of learning, with changes in estimated sensitivity increasing once bias was corrected for. The possible causes of bias and the implications for our understanding of perceptual learning are discussed.

A perspective on judgment and choice: Mapping bounded rationality

DOI:10.1037/0003-066X.58.9.697

URL

PMID:14584987

[本文引用: 1]

Early studies of intuitive judgment and decision making conducted with the late Amos Tversky are reviewed in the context of two related concepts: an analysis of accessibility, the ease with which thoughts come to mind; a distinction between effortless intuition and deliberate reasoning. Intuitive thoughts, like percepts, are highly accessible. Determinants and consequences of accessibility help explain the central results of prospect theory, framing effects, the heuristic process of attribute substitution, and the characteristic biases that result from the substitution of nonextensional for extensional attributes. Variations in the accessibility of rules explain the occasional corrections of intuitive judgments. The study of biases is compatible with a view of intuitive thinking and decision making as generally skilled and successful.

Prospect theory: An analysis of decision under risk

DOI:10.2307/1914185

URL

[本文引用: 4]

No abstract is available for this item.

Experimental tests of the endowment effect and the coase theorem

DOI:10.1086/261737

URL

[本文引用: 5]

Contrary to theoretical expectations, measures of willingness to accept greatly exceed measures of willingness to pay. This paper reports several experiments that demonstrate that this "endowment effect" persists even in market settings with opportunities to learn. Consumption objects (e.g., coffee mugs) are randomly given to half the subjects in an experiment. Markets for the mugs are then conducted. The Coase theorem predicts that about half the mugs will trade, but observed volume is always significantly less. When markets for "induced-value" tokens are conducted, the predicted volume is observed, suggesting that transactions costs cannot explain the undertrading for consumption goods.

Empirical generalizations from reference price research

DOI:10.1287/mksc.14.3.G161 URL [本文引用: 2]

A region of mesial prefrontal cortex tracks monetarily rewarding outcomes: Characterization with rapid event-related fMRI

DOI:10.1016/s1053-8119(02)00057-5

URL

PMID:12595181

[本文引用: 1]

The function of the mesial prefrontal cortex (MPFC: including Brodman areas 10/12/32) remains an enigma. Current theories suggest a role in representing internal information, including emotional introspection, autonomic control, and a "default state" of semantic processing. Recent evidence also suggests that parts of this region may also play a role in processing reward outcomes. In this study, we investigated the possibility that a region of the MPFC would be preferentially recruited by monetary reward outcomes using a parametric monetary incentive delay (MID) task. Twelve healthy volunteers participated in functional magnetic resonance scans while playing the MID task. Group analyses indicated that while the ventral striatum was recruited by anticipation of monetary reward, a region of the MPFC instead responded to rewarding monetary outcomes. Specifically, volume-of-interest analyses indicated that when volunteers received dollar sign5.00 after anticipating a dollar sign5.00 win, MPFC activity increased, whereas when volunteers did not receive dollar sign5.00 after anticipating a dollar sign5.00 win, MPFC activity decreased, relative to outcomes with no incentive value. These findings suggest that in the context of processing monetary rewards, a region of the MPFC preferentially tracks rewarding outcomes.

Neural antecedents of the endowment effect

DOI:10.1016/j.neuron.2008.05.018

URL

PMID:18549791

[本文引用: 3]

The “endowment effect” refers to the tendency to place greater value on items that one owns—an anomaly that violates the reference-independence assumption of rational choice theories. We investigated neural antecedents of the endowment effect in an event-related functional magnetic resonance imaging (fMRI) study. During scanning, 24 subjects considered six products paired with 18 different prices under buying, choosing, or selling conditions. Subjects showed greater nucleus accumbens (NAcc) activation for preferred products across buy and sell conditions combined, but greater mesial prefrontal cortex (MPFC) activation in response to low prices when buying versus selling. During selling, right insular activation for preferred products predicted individual differences in susceptibility to the endowment effect. These findings are consistent with a reference-dependent account in which ownership increases value by enhancing the salience of the possible loss of preferred products.

The endowment effect and legal analysis

DOI:10.2139/ssrn.326360

URL

[本文引用: 1]

Most legal scholarship implicitly adopts the assumption of the Coase Theorem that the value an individual places on a legal entitlement is independent of whethe

A model of reference- dependent preferences

DOI:10.1162/qjec.121.4.1133

URL

[本文引用: 2]

We develop a model of reference-dependent preferences and loss aversion where "gain-loss utility" is derived from standard "consumption utility" and the reference point is determined endogenously by the economic environment. We assume that a person's reference point is her rational expectations held in the recent past about outcomes, which are determined in a personal equilibrium by the requirement that they must be consistent with optimal behavior given expectations. In deterministic environments, choices maximize consumption utility, but gain-loss utility influences behavior when there is uncertainty. Applying the model to consumer behavior, we show that willingness to pay for a good is increasing in the expected probability of purchase and in the expected prices conditional on purchase. In within-day labor-supply decisions, a worker is less likely to continue work if income earned thus far is unexpectedly high, but more likely to show up as well as continue work if expected income is high.

Endowment effect in capuchin monkeys

DOI:10.1098/rstb.2008.0149

URL

PMID:2581778

[本文引用: 2]

In humans, the capacity for economically rational choice is constrained by a variety of preference biases: humans evaluate gambles relative to arbitrary reference points; weigh losses heavier than equally sized gains; and demand a higher price for owned goods than for equally preferred goods that are not yet owned. To date, however, fewer studies have examined the origins of these biases. Here, we review previous work demonstrating that human economic biases such as loss aversion and reference dependence are shared with an ancestrally related New World primate, the capuchin monkey (Cebus apella). We then examine whether capuchins display an endowment effect in a token-trading task. We identified pairs of treats (fruit discs versus cereal chunks) that were equally preferred by each monkey. When given a chance to trade away their owned fruit discs to obtain the equally valued cereal chunks (or vice versa), however, monkeys required a far greater compensation than the equally preferred treat. We show that these effects are not due to transaction costs or timing issues. These data suggest that biased preferences rely on cognitive systems that are more evolutionarily ancient than previously thought--and that common evolutionary ancestry shared by humans and capuchins may account for the occurrence of the endowment effect in both species.

The role of emotions in the endowment effect

DOI:10.1016/j.joep.2005.10.001

URL

[本文引用: 1]

This paper argues that the endowment effect – the tendency for minimum selling price to exceed maximum buying price for a particular object – might be minimized when a negative emotion is induced. The findings from two experiments on 400 participants support this hypothesis: the endowment effect only occurs when participants are induced to feel happy, and is absent when people are induced to feel sadness. Thus, the importance of emotional states is highlighted.

Role of social value orientation in the endowment effect

DOI:10.1111/j.1467-839X.2006.00199.x

URL

[本文引用: 1]

The purpose of the present research was to explore the role of social value orientation in the endowment effect. The study gathered 190 participants from university students in Taiwan: 74 of these were classified as individualists, 44 as competitors and 56 as prosocials, with 16 being unclassified. Results from an experimental study indicated that the individualists' and competitors' average selling prices were significantly higher than the average buying prices for a commodity; thus the endowment effect was observed in these two orientations. The endowment effect was not observed in those having a prosocial orientation, however.

Does market experience eliminate market anomalies?

DOI:10.1162/00335530360535144

URL

[本文引用: 2]

This study examines individual behavior in two well-functioning marketplaces to investigate whether market experience eliminates the endowment effect. Field evidence from both markets suggests that individual behavior converges to the neoclassical prediction as market experience increases. In an experimental test of whether these observations are due to treatment (market experience) or selection (e.g., static preferences), I find that market experience plays a significant role in eliminating the endowment effect. I also find that these results are robust to institutional change and extend beyond the two marketplaces studied. Overall, this study provides strong evidence that market experience eliminates an important market anomaly.

Explanations of the endowment effect: An integrative review

DOI:10.1016/j.tics.2015.04.004

URL

PMID:25939336

[本文引用: 4]

The endowment effect is the tendency for people who own a good to value it more than people who do not. Its economic impact is consequential. It creates market inefficiencies and irregularities in valuation such as differences between buyers and sellers, reluctance to trade, and mere ownership effects. Traditionally, the endowment effect has been attributed to loss aversion causing sellers of a good to value it more than buyers. New theories and findings – some inconsistent with loss aversion – suggest evolutionary, strategic, and more basic cognitive origins. In an integrative review, we propose that all three major instantiations of the endowment effect are attributable to exogenously and endogenously induced cognitive frames that bias which information is accessible during valuation.

Bad riddance or good rubbish? Ownership and not loss aversion causes the endowment effect

DOI:10.1016/j.jesp.2009.05.014

URL

[本文引用: 4]

People typically demand more to relinquish the goods they own than they would be willing to pay to acquire those goods if they did not already own them (the endowment effect). The standard economic explanation of this phenomenon is that people expect the pain of relinquishing a good to be greater than the pleasure of acquiring it (the loss aversion account). The standard psychological explanation is that people are reluctant to relinquish the goods they own simply because they associate those goods with themselves and not because they expect relinquishing them to be especially painful (the ownership account). Because sellers are usually owners, loss aversion and ownership have been confounded in previous studies of the endowment effect. In two experiments that deconfounded them, ownership produced an endowment effect but loss aversion did not. In Experiment 1, buyers were willing to pay just as much for a coffee mug as sellers demanded if the buyers already happened to own an identical mug. In Experiment 2, buyers brokers and sellers brokers agreed on the price of a mug, but both brokers traded at higher prices when they happened to own mugs that were identical to the ones they were trading. In short, the endowment effect disappeared when buyers were owners and when sellers were not, suggesting that ownership and not loss aversion causes the endowment effect in the standard experimental paradigm.

Constructing preference from experience: The endowment effect reflected in external information search

DOI:10.1037/a0027637

URL

PMID:22409180

[本文引用: 1]

People often attach a higher value to an object when they own it (i.e., as seller) compared with when they do not own it (i.e., as buyer) phenomenon known as the endowment effect. According to recentcognitive process accounts of the endowment effect, the effect is due to differences between sellers and buyers in information search. Whereas previous investigations have focused on search order and internalsearch processes (i.e., in memory), we used a sampling paradigm to examine differences in search termination in external search. We asked participants to indicate selling and buying prices for monetarylotteries in a within-subject design. In an experience condition, participants had to learn about the possible outcomes and probabilities of the lotteries by experiential sampling. As hypothesized, sellers tended to terminate search after sampling high outcomes, whereas buyers tended to terminate search after sampling low outcomes. These differences in stopping behavior translated into samples of the lotteries that were differentially distorted for sellers and buyers; the amount of the distortion was predictive of the resulting size of the endowment effect. In addition, for sellers search was more extended when high outcomes were rare compared with when low outcomes were rare. Our results add to the increasing evidence that the endowment effect is due, in part, to differences in predecisional information search.

Unpacking buyer- seller differences in valuation from experience: A cognitive modeling approach

DOI:10.3758/s13423-017-1237-4

URL

PMID:28265866

[本文引用: 1]

Abstract People often indicate a higher price for an object when they own it (i.e., as sellers) than when they do not (i.e., as buyers)-a phenomenon known as the endowment effect. We develop a cognitive modeling approach to formalize, disentangle, and compare alternative psychological accounts (e.g., loss aversion, loss attention, strategic misrepresentation) of such buyer-seller differences in pricing decisions of monetary lotteries. To also be able to test possible buyer-seller differences in memory and learning, we study pricing decisions from experience, obtained with the sampling paradigm, where people learn about a lottery's payoff distribution from sequential sampling. We first formalize different accounts as models within three computational frameworks (reinforcement learning, instance-based learning theory, and cumulative prospect theory), and then fit the models to empirical selling and buying prices. In Study 1 (a reanalysis of published data with hypothetical decisions), models assuming buyer-seller differences in response bias (implementing a strategic-misrepresentation account) performed best; models assuming buyer-seller differences in choice sensitivity or memory (implementing a loss-attention account) generally fared worst. In a new experiment involving incentivized decisions (Study 2), models assuming buyer-seller differences in both outcome sensitivity (as proposed by a loss-aversion account) and response bias performed best. In both Study 1 and 2, the models implemented in cumulative prospect theory performed best. Model recovery studies validated our cognitive modeling approach, showing that the models can be distinguished rather well. In summary, our analysis supports a loss-aversion account of the endowment effect, but also reveals a substantial contribution of simple response bias.

If I touch it I have to have it: Individual and environmental influences on impulse purchasing

DOI:10.1016/j.jbusres.2006.01.014

URL

[本文引用: 1]

This research examines the influence of touch on impulse-purchasing behavior. We first replicate the Rook and Fisher [Rook DW, Fisher RJ. Normative influences on impulsive buying behavior. J Consum Res 1995;22:305 13.] studies about the moderating effect of the normative evaluation of impulse purchase on impulse-purchasing behavior. Extending the impulse-purchasing literature, we examine individual differences in touch and how they affect impulsive-buying behavior. Results from a field experiment suggest that both individual and environmental touch-related factors increase impulse purchasing.

The effect of mere touch on perceived ownership

The willingness to pay-willingness to accept gap, the "endowment effect," subject misconceptions, and experimental procedures for eliciting valuations

DOI:10.1257/0002828054201387 URL [本文引用: 7]

The willingness to pay-willingness to accept gap, the “endowment effect" subject misconceptions, and experimental procedures for eliciting valuations: Reply

DOI:10.1257/aer.101.2.1012 URL [本文引用: 3]

Possession, feelings of ownership and the endowment effect

DOI:10.1007/s10964-007-9176-4

URL

[本文引用: 1]

Research in judgment and decision making generally ignores the distinction between factual and subjective feelings of ownership, tacitly assuming that the two correspond closely. The present research suggests that this assumption might be usefully reexamined. In two experiments on the endowment effect we examine the role of subjective ownership by independently manipulating factual ownership (i.e., what participants were told about ownership) and physical possession of an object. This allowed us to disentangle the effects of these two factors, which are typically confounded. We found a significant effect of possession, but not of factual ownership, on monetary valuation of the object. Moreover, this effect was mediated by participants feelings of ownership, which were enhanced by the physical possession of the object. Thus, the endowment effect did not rely on factual ownership per se but was the result of subjective feelings of ownership induced by possession of the object. It is these feelings of ownership that appeared to lead individuals to include the object into their endowment and to shift their reference point accordingly. Potential implications and directions for future research are discussed.

The neural basis of economic decision-making in the ultimatum game

DOI:10.1126/science.1082976

URL

PMID:12805551

[本文引用: 1]

The nascent field of neuroeconomics seeks to ground economic decision-making in the biological substrate of the brain. We used functional magnetic resonance imaging of Ultimatum Game players to investigate neural substrates of cognitive and emotional processes involved in economic decision-making. In this game, two players split a sum of money; one player proposes a division and the other can accept or reject this. We scanned players as they responded to fair and unfair proposals. Unfair offers elicited activity in brain areas related to both emotion (anterior insula) and cognition (dorsolateral prefrontal cortex). Further, significantly heightened activity in anterior insula for rejected unfair offers suggests an important role for emotions in decision-making.

The effect of giving it all up on valuation: A new look at the endowment effect

DOI:10.1287/mnsc.2013.1783

URL

[本文引用: 1]

In three experiments we show that the endowment effect---the tendency to demand more money for relinquishing owned goods than one is willing to pay for the same goods---fails to emerge when sellers are not fully depleted of their endowment. This finding is incompatible with prospect theory's account of the effect as stemming primarily from aversion to loss relative to the individual's current state. We suggest a new account of the endowment effect as reflecting the human aversion to “giving it all up” rather than simply an aversion to incurring any loss relative to the status quo. Experiments 1 and 2 show the effect employing a pricing paradigm. Experiment 3 examines what constitutes “all” in the giving-it-all-up effect. This paper was accepted by Uri Gneezy, behavioral economics.

Resolving differences in willingness to pay and willingness to accept

DOI:10.1016/S0169-5150(96)01204-2

URL

[本文引用: 2]

This paper tests the conjecture that the divergence of willingness to pay (WTP) and willingness to accept (WTA) for identical goods is driven by the degree of substitution between goods. In contrast to well-known results for market goods with close substitutes (i.e., candy bars and coffee mugs), our results indicate a convergence of WTP and WTA measures of value. However, for a nonmarket good with imperfect substitutes (i.e., reduced health risk), the divergence of WTP and WTA value measures is persistent, even with repeated market participation and full information on the nature of the good.

Psychological ownership and affective reaction: Emotional attachment process variables and the endowment effect

DOI:10.1016/j.jcps.2011.01.002

URL

[本文引用: 5]

This research proposes that the concept of emotional attachment, and specifically the independent constructs of psychological ownership and affective reaction, can help explain many of the endowment effect findings documented in the literature. We define these constructs and then test them across a set of nine studies in which we both replicate previous and generate new endowment effect findings, and then show that psychological ownership and affective reaction can mediate the effects. In doing so, we offer direct empirical support for the idea of emotional attachment as a driver of loss aversion while also providing practitioners and future endowment effect researchers with new insights about the psychological processes that underlie the endowment effect.

Anchoring effects on consumers' willingness-to-pay and willingness-to-accept

DOI:10.1086/jcr.2004.31.issue-3 URL [本文引用: 2]

Memory retrieval processes help explain the incumbency advantage

The effect of ownership history on the valuation of objects

DOI:10.1086/jcr.1998.25.issue-3 URL [本文引用: 3]

The impact of locus of control and priming on the endowment effect

DOI:10.1111/j.1467-9450.2011.00890.x

URL

PMID:21658030

[本文引用: 1]

Sun, Y.-C. (2011). The impact of locus of control and priming on the endowment effect. Scandinavian Journal of Psychology 52, 420 426.This paper demonstrates the effects of different priming conditions on the endowment effect with respect to seller and buyer roles for individuals with different loci of control. Individuals with an external locus of control process information less rationally, and they are more susceptible to external influences. In addition, the literature reports that when individuals are making a purchasing decision, they tend to perceive the value of the product as being higher because of its utility aspect because decision makers search for reasons and arguments to justify their choices (Shafir 1993; Tversky & Griffin, 1991). Therefore, this study investigates the effects of different priming conditions (utilitarian priming vs. hedonic priming) on the endowment effect according to each type of locus of control (internal vs. external). The results showed that the endowment effect was larger when externals were exposed to utilitarian priming as opposed to hedonic priming. Finally, the implications of these findings and suggestions for future research are discussed.

The role of attention in motivated behavior

DOI:10.1037/xge0000088

URL

PMID:26097978

[本文引用: 1]

All too frequently, people fail to take actions that are in their best interest (e.g., not taking necessary medications). Researchers have attempted to explain such behaviors by identifying subtle motivational forces that foster an avoidance of attractive outcomes. However, in many cases, such motivational forces have been difficult to identify. We propose that failures such as these to act in valued ways are in some cases caused by insufficient levels of orienting attention. To test this hypothesis, we first created a laboratory analog of real-world failures to act in valued ways, 1 in which participants persisted in viewing lower-valenced images even though they could have, at no cost, viewed a higher-valenced image. When we experimentally increased their orienting attention toward a caption stating they had the option to switch, participants more frequently elected to view the higher valenced image (Studies 1a-c). In real-world behavioral contexts, increasing attention, without an apparent change in valuation, also led to increased levels of approach motivation in behavioral contexts involving purchasing apples (Study 2) and electing to take the stairs instead of the escalator (Studies 3a-c). In light of these findings, we consider the role of orienting attention in motivated behavior.

Money is no object: Testing the endowment effect in exchange goods

DOI:10.1016/j.jebo.2014.07.003

URL

[本文引用: 1]

We present a new experimental design to test whether the endowment effect exists for exchange goods, like money. We compare three groups to a baseline: one endowed with money, one endowed with chocolate coins, and one endowed with chocolate coins described as “tokens.” We find an endowment effect for chocolate coins, but no endowment effect for money or for chocolate coins when they are described as tokens. The results suggest that the endowment effect does not exist for exchange goods.

Toward a positive theory of consumer choice

DOI:10.1016/0167-2681(80)90051-7

URL

[本文引用: 7]

The economic theory of the consumer is a combination of positive and normative theories. Since it is based on a rational maximizing model it describes how consumers should choose, but it is alleged to also describe how they do choose. This paper argues that in certain well-defined situations many consumers act in a manner that is inconsistent with economic theory. In these situations economic theory will make systematic errors in predicting behavior. Kanneman and Tversey's prospect theory is proposed as the basis for an alternative descriptive theory. Topics discussed are: undeweighting of opportunity costs, failure to ignore sunk costs, scarch behavior choosing not to choose and regret, and precommitment and self-control.

Misbehaving: The making of behavioral economics

.

A new meta-analysis on the WTP/WTA disparity

DOI:10.1016/j.jeem.2014.06.001

URL

[本文引用: 1]

This study reports a new meta-analysis of papers that elicit willingness-to-pay (WTP) and willingness-to-accept compensation (WTA) measures of value for the same good. We investigate the effects of type of good and several survey-design features on the WTP/WTA disparity, measured as the logarithm of the ratio of mean WTA to mean WTP. Confirming Horowitz and McConnell s (2002) pioneering meta-analysis, we find the disparity is smaller for ordinary private goods than for public and non-market goods, that it is not solely an artifact of using hypothetical transactions or other weak experimental or survey methods, and that it is smaller for studies using student subjects. In addition, we find that the disparity is smaller when subjects have experience valuing the good in real markets or through repeated experimental trials. In contrast to Horowitz and McConnell, we find the disparity is significantly smaller in studies using incentive-compatible elicitation mechanisms. The disparity is smaller in more recent studies, an effect that is attributable only in part to changes in study characteristics.

When does construction enhance product value? Investigating the combined effects of object assembly and ownership on valuation

DOI:10.1002/bdm.1931

URL

[本文引用: 1]